Uncategorized

Understanding your super and pension statements

Confused by what all the facts and figures mean on your super or pension statements? Don’t despair – here’s how to translate them.

Read MoreTax deductions specifically for SMSFs

One overarching fundamental that SMSF trustees should ideally keep in mind is the sole purpose test – that is, every decision made and action taken is required to be seen as being undertaken for the sole purpose of providing retirement benefits for the fund’s members.

Read MoreWinning gold in retirement savings

Our Olympian contingent arrived back from from Rio with a collective 29 medals, eight of them gold, securing Australia 10th place overall. But our Olympic champions take extra comfort knowing that they are back in a country where self managed superannuation funds are consistently taking 1st place and standing on the highest podium to take the gold medal for best performance.

Read MoreTED Talks: James Veitch – The agony of trying to unsubscribe

It happens to all of us – you unsubscribe from an unwanted marketing email, and a few days later another message from the same company pops up in your inbox.

Comedian James Veitch turned this frustration into whimsy when a local supermarket refused to take no for an answer. Hijinks ensued.

Read MoreThe process (and pros and cons) of “electing” to be a family trust

Trusts are an important and very useful concept for managing one’s financial affairs, as well as estate planning.

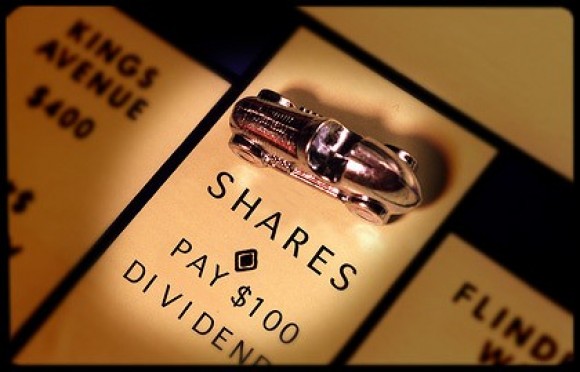

Read MoreShare dividend income and franking credits

Mum and dad investors in receipt of dividends from their share portfolio often benefit from investing in blue chip shares because they usually have franking credits attached.

Read More$20,000 write off is only available for small business, unless…

There is an under-used gem hidden within the small business simplified depreciation rules that in some circumstances can widen the opportunity to access this valuable deduction.

Read MoreGeneral facts about winding up your business

There are times where business owners, whether voluntarily or involuntarily, may need to wind up their business.

It is generally less complicated to wind up the business of a sole trader (who has declared “bankruptcy”) than to wind up a business run through other structures.

For companies, the terms typically used would be to “go into administration” or “liquidation”

A sole trader is less complicated to wind up because the principal of the business is also personally responsible for all debts and liabilities accrued by that business.

Read MoreTED Talks: Olivier Scalabre – The next manufacturing revolution is here

Economic growth has been slowing for the past 50 years, but relief might come from an unexpected place – a new form of manufacturing that is neither what you thought it was nor where you thought it was.

Industrial systems thinker Olivier Scalabre details how a fourth manufacturing revolution will produce a macroeconomic shift and boost employment, productivity and growth.

Read More8 tips to avoid cybercrime

As digital customers, we use the internet everyday to login to personal and banking accounts, check news updates or to log on to social media. We perform so many tasks using the internet, believing that it’s safe, that we tend to neglect security and preventative measures to deter cyber-criminals and fraudsters.

Read More