Uncategorized

Work deductions – What’s on the taxman’s radar?

The ATO says that this year it will pay extra attention to people whose deduction claims are higher than expected, in particular those claiming car expenses.

The expenses the ATO says it will be scrutinising can include claims by those transporting bulky tools, and deductions for travel, internet and mobile phone as well as claims for self-education expenses.

Read MoreReal estate – Buyers turned into tax collectors

New withholding rules on the sale of property by foreign residents have been introduced. This essentially turns property buyers into potential tax collectors.

Read MoreClient in Focus: Cateraid

Our client in focus for this month is Cateraid.

Passionate owner, Greg Stephenson, shares with us the success of his business and discusses the challenges he and his team overcome on a day-to-day basis.

Read MoreClient in Focus: Central Coast Disability Network

Our client in focus for this month is Central Coast Disability Network.

We speak with CEO, Jenny MacKellin, on the establishment of the organisation, discussing its’ changes over time and how the team has responded to recent challenges within the industry.

Read MoreTaxpayers still guilty until proven innocent

Small business and individual taxpayers hit with hefty tax bills that they want to dispute will continue to be held guilty until proven innocent, and the Australian Taxation Office won’t have its appeals and compliance functions split under a separate commissioner, the Federal Government has said.

Read MoreBuilding a new home? Is it exempt from CGT?

There is a concession in the CGT rules that can allow a taxpayer to treat a property as their “main residence” even though it does not yet have a habitable dwelling.

Read More5 things you need to know to ride out a volatile stock market

1. Watching from the sidelines may cost you When markets become volatile, a lot of people try to guess when stocks will bottom out. In the meantime, they often park their investments in cash. But just as many investors are slow to recognise a retreating stock market, many also fail to see an upward trend…

Read MoreTED Talks: Danit Peleg – Forget shopping. Soon you’ll download your new clothes

Downloadable, printable clothing may be coming to a closet near you. What started as designer Danit Peleg’s fashion school project turned into a collection of 3D-printed designs that have the strength and flexibility for everyday wear.

“Fashion is a very physical thing,” Danit says. “I wonder what our world will look like when our clothes will be digital.”

Read MoreTED Talks: Achenyo Idachaba – How I turned a deadly plant into a thriving business

The water hyacinth may look like a harmless, even beautiful flowering plant – but it’s actually an invasive aquatic weed that clogs waterways, stopping trade, interrupting schooling and disrupting everyday life.

In this scourge, green entrepreneur Achenyo Idachaba saw opportunity. Follow her journey as she turns weeds into woven wonders.

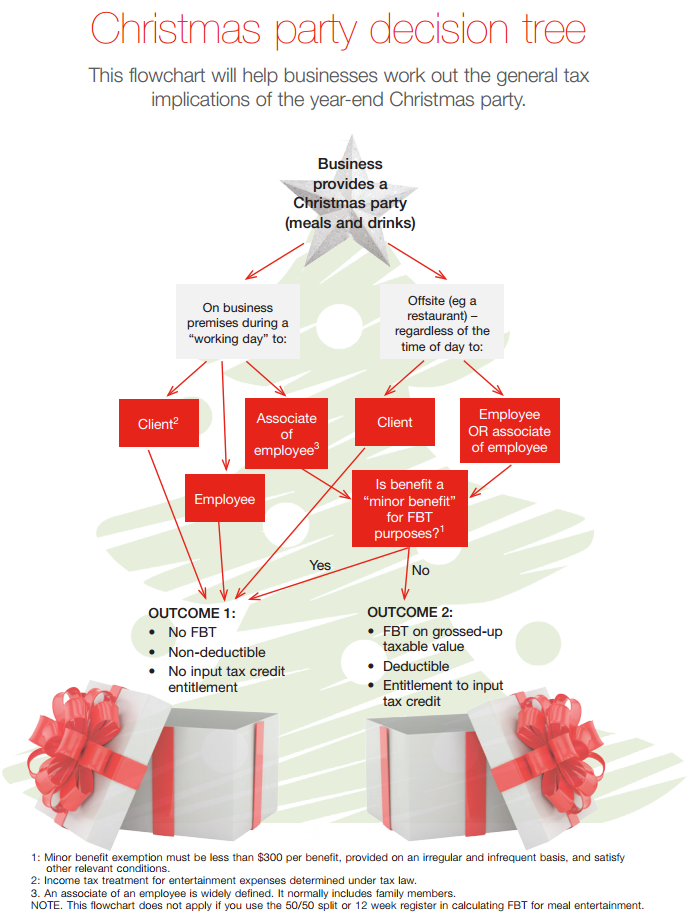

Read MoreChristmas party: Examples from the ATO

The Christmas party decision tree – this flowchart will help businesses work out the general tax implications of the year-end Christmas party.

Read More