Market Updates

Federal Budget 2021/2022

On Tuesday 11 May 2021, Treasurer Josh Frydenberg handed down the 2021 Federal Budget on Tuesday, his 3rd Budget. The Australian economy has rebounded at its fastest pace on record over the latter half of 2020. Nevertheless, 2021-22 Federal Budget deficit is $161 billion, which is $53 billion lower than what was initially projected in…

Read MoreMarket Update

US elections and daily pandemic updates, are dominating the news headlines. With this constant flow of information, investors must be focused on their long-term goals and learn to tune out the noise of the crowd. Following the sharp falls in February and rebound in March, the markets have been fluctuating daily mostly in a positive…

Read MoreMarket Update

Sharemarkets continue to fall on the back of growing concerns about the spread of the coronavirus. At times of heightened market volatility, it’s easy to fear how your superannuation and other investments might be affected, but it’s important to understand the nature of market movements before making any sudden decisions. Falls are normal, even without…

Read MoreMarket and Business Update #5 – COVID-19 & NSW Stimulus Package

Business to receive further support: Further to the $17.6 billion Federal Stimulus Package announced last week, the NSW Government announced this morning a second stimulus package that will apply to health and business industries. The NSW Government will inject $2.3 billion into healthcare, business and cleaning. $1.6 billion will go towards business, with the intention…

Read MoreMarket and Business Update #4 – COVID-19 & Federal Stimulus Package

Yesterday, The Australian Federal Government announced a stimulus package for the economy. This has significant relevance to the small and medium business sector. There are six key measures valued at $17.6billion – 90% of which will be paid to business and individuals between 31 March and mid-April. These include: Wage subsidies for Apprentices and Trainees…

Read MoreMarket Update #3 – General Advice

Market volatility continues. Here’s what we know now. As it stands this morning, the market has declined a further 7.8%. Likely triggers: COVID-19 continues to spread across the world. The share market is responding to the threat of further spread, as well as government policy responses. The US Presidential candidacy is underway, with Election…

Read MoreMarket Update #2 – Coronavirus and the impact on markets

In the past week or so, we’ve seen share markets fall on the back of growing concerns about the spread of the coronavirus. At times of heightened market volatility, it’s easy to fear how your superannuation and other investments might be affected, but it’s important to understand the nature of market movements before making any…

Read MoreMarket Update #1 – Coronavirus

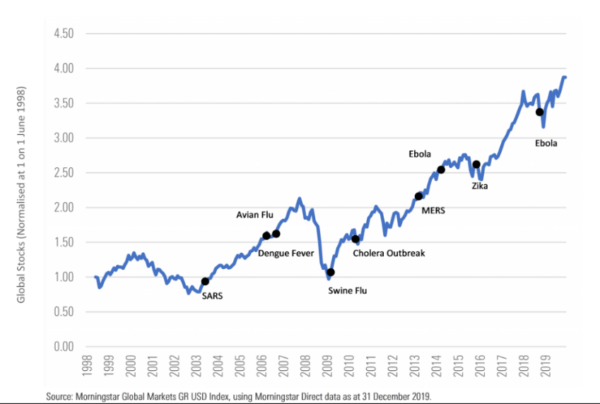

Further to our recent market update email, the uncertainty that surrounds the coronavirus has impacted equity markets over the last week. While we can’t know the true extent or timeframe of this market performance and business landscape, there are number of important facts to note. What we know: The issue is escalating. The number of…

Read MoreMarket update: Coronavirus

Yesterday, the World Health Organisation (WHO) declared the coronavirus epidemic a “public health emergency of international concern”. They acknowledged China for “setting a new standard for outbreak response” and called for a “measured and evidence-based response”. In terms of trade and investment, the WHO said: “There is no reason for measures that unnecessarily interfere with…

Read More