Posts by Robson Partners

Deceased estates: A brief guide to tying up the loose ends

After a person dies, and the usual arrangements are completed, there will come a time when other matters, such as tax and superannuation issues, must be looked after. The person who takes on the responsibility for administering a deceased estate is commonly referred to as the executor, but could also be known as an administrator or a legal personal representative.

Read MoreActive vs passive assets and the small business CGT concession

The small business capital gains tax concessions are extremely valuable. For small business owners who need to dispose of assets that have risen in value during the time they have owned them, accessing these concessions can mean greatly reducing any consequent tax liability, even to zero.

Read More10 tips for rental property owners to avoid common tax mistakes

Below is a list of tips from the Australian Taxation Office that should help rental property owners avoid what it has found are the 10 most common tax errors made by rental property investors. The ATO says that avoiding these tax mistakes will save many taxpayers both time and money.

Read MoreTED Talks: Tricia Wang – The human insights missing from big data

Why do so many companies make bad decisions, even with access to unprecedented amounts of data? With stories from Nokia to Netflix to the oracles of ancient Greece, Tricia Wang demystifies big data and identifies its pitfalls, suggesting that we focus instead on “thick data” – precious, unquantifiable insights from actual people – to make the right business decisions and thrive in the unknown.

Read MoreTax deductions specifically for SMSFs

One overarching fundamental that SMSF trustees should ideally keep in mind is the sole purpose test – that is, every decision made and action taken is required to be seen as being undertaken for the sole purpose of providing retirement benefits for the fund’s members.

Read MoreUnderstanding your super and pension statements

Confused by what all the facts and figures mean on your super or pension statements? Don’t despair – here’s how to translate them.

Read MoreSubstantiation for mobile, home phone and internet costs

The ATO has issued guidance on making claims for mobile phone use as well as home phone and internet expenses, and says that if you use any of these for work purposes you should be able to claim a deduction if there are records to support claims.

Read MoreTED Talks: Adam Grant – Are you a giver or a taker?

In every workplace, there are three basic kinds of people: givers, takers and matchers. Organisational psychologist Adam Grant breaks down these personalities and offers simple strategies to promote a culture of generosity and keep self-serving employees from taking more than their share.

Read MoreCan salary sacrifice work for you?

Salary sacrifice can be a great way to get a part of your remuneration in a form other than cash – and not personally pay tax on it.

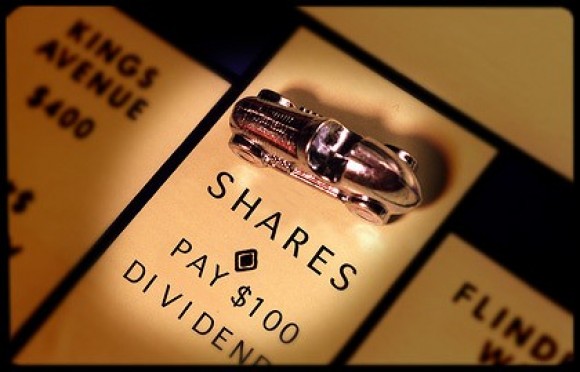

Read MoreShare dividend income and franking credits

Mum and dad investors in receipt of dividends from their share portfolio often benefit from investing in blue chip shares because they usually have franking credits attached.

Read More