Archive for October 2018

Taking cover: 5 types of business insurance you should consider

Whoever said, “You can never have too much insurance” obviously never had to pay the premiums. Still, there’s no denying the fact you need it to protect your business and its assets.

Read MoreSuperannuation Changes – Need to act NOW… but what do I do?

The 2016 Budget saw some changes announced by the Government which are now in place, with key reforms coming into effect from 1 July 2017.

These are the BIGGEST changes to happen in Superannuation for over a decade, and they will have an impact for decades to come.

Read MoreSmart ways to ease yourself into retirement, pay less tax and boost your super

Two things first up: (1) If you want to (or have to) work past the age of 55, you need to read this article; or (2) If you know someone else who that applies to, please forward them this article or a link to it.

They’ll thank you for it.

Read MoreSmall Business, Big Decisions: Why savvy business owners ‘rent’ CFO-level experience

Larger businesses have a Chief Financial Officer (CFO) of staff. But what can small and medium sized businesses do in this regard?

Read MoreON versus IN: Why you should work on your business instead of just in it

“You need to work on your business, not just in your business.”

Read MoreManaging receipts: How small businesses are banishing bookkeeping boredom

They say only two things are certain in life: death and taxes. For a lot of people, there’s also a third certainty in life: the pain of keeping track of every receipt when it’s time to do the taxes.

Read MoreLinkedIn for Small Business

If someone gave you the opportunity to attend a meeting where thousands of your prospects were also present, you’d be silly not to take them up on the offer…right?

Read MoreKey Person Insurance: Could your business survive losing one if its key people?

As much as you try to share skills, knowledge and information in your company, you probably have some people who are key to your business’ success.

Read MoreGo Fund Me Go – New crowd funding laws for businesses

Industry news:

From 15 October 2018, a private company will be able to raise capital from the public.

The Senate passed the Corporations Amendment (Crowd Sourced Funding for Proprietary Companies) Bill 2017 on 12th September 2018.

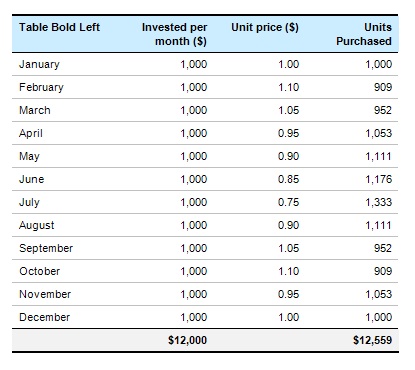

Read MoreDollar Cost Averaging

Making regular deposits into an investment fund can provide you with significant benefits.

By making small regular deposits rather than one large lump sum deposit, you can reduce the vulnerability of your investment to market fluctuations. For example, if you commit to investing $1,000 a month in January. With a unit price of $1.00, your first instalment purchases 1,000 units. The next month, you invest another $1,000 but this time the unit price has risen to $1.10, buying you 909 units. This is illustrated in the table below.

Read More