Posts by AdviceCo.

Payday Super: 6 things every small business needs to know before 1 July 2026

If you employ staff, one of the biggest changes to hit your business in years is coming on 1 July 2026. It’s called Payday Super, and it fundamentally changes how and when you pay superannuation. Under the current system, you have until 28 days after the end of each quarter to pay your employees’ super.…

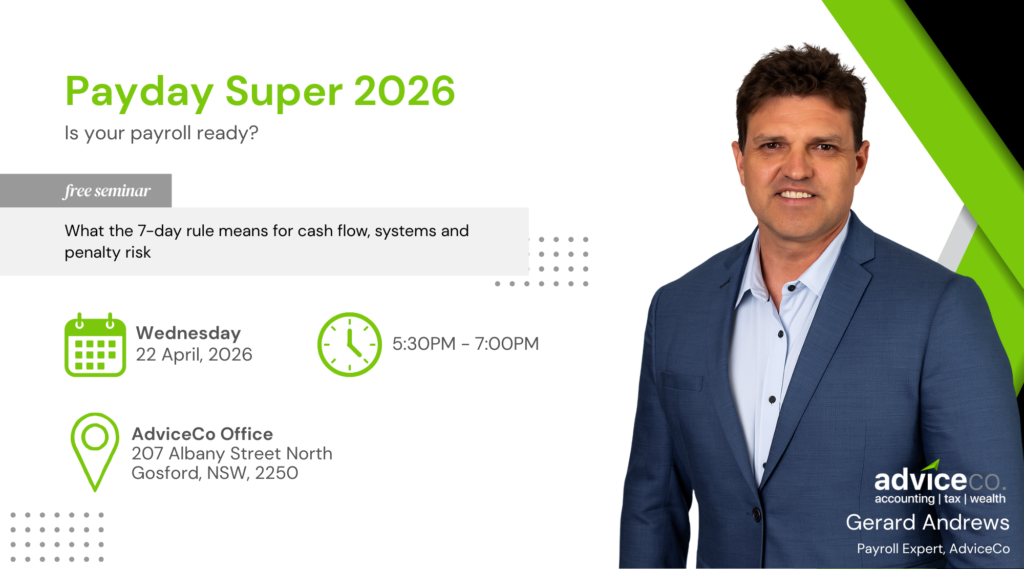

Read MorePayday Super 2026: Is your payroll ready?

If you employ staff, one of the biggest changes to hit your business in years is coming on 1 July 2026. It’s called Payday Super, and it fundamentally changes how and when you pay superannuation. Instead of quarterly super contributions, employers will be required to make payments every pay cycle — and the fund must…

Read MoreDivision 296 Tax: Changes to super tax on high balances – What it means for you

The Government’s reforms to superannuation taxation (via the proposed Better Targeted Superannuation Concessions Bill) introduce a major shift in how investment earnings in super will be taxed for individuals with large balances. Key components (as at October 2025) include: In simple terms: for individuals with very large super balances, investment returns in their super will…

Read MoreMarket Volatility – Recent Tariff Announcements and Market Impacts

As you may know, the Trump administration has recently implemented (and subsequently altered) tariffs targeting all countries, mainly China. These tariffs are part of the administration’s broader strategy to address trade imbalances, protect American industries, and encourage domestic manufacturing. While these measures aim to strengthen the U.S. economy, they have caused short-term volatility in financial…

Read MoreKey Highlights from the 2025-26 Australian Federal Budget

On March 25, 2025, Treasurer Jim Chalmers delivered the Australian Federal Budget for the 2025–26 financial year. This budget, presented on the eve of a federal election, seeks to balance fiscal responsibility with measures aimed at alleviating the cost of living for Australians. Fiscal Outlook The budget projects an underlying cash deficit of $27.6 billion…

Read MoreMarket Wrap – February 2025

Economic and Market Overview Global US Australia New Zealand Europe Asia Australian dollar Australian equities Global equities Property securities Fixed income and credit Market Watch Data Sheet Important information This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives,…

Read More