b-Mail

Our regular commitment to bringing you news across the areas of tax, accounting and wealth.

The process (and pros and cons) of “electing” to be a family trust

A trust is established whenever there is a separation of the legal ownership (for example, the name appearing on a...

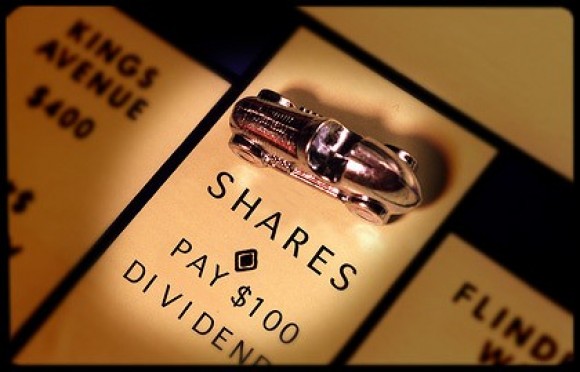

Share dividend income and franking credits

As a general rule, an Australian resident shareholder is assessed for tax on dividends received plus any franking credits attached...

$20,000 write off is only available for small business, unless…

Everyone assumes that the $20,000 instant asset write-off is exclusive to eligible small businesses. But it is possible, under certain...

General facts about winding up your business

Dealing with a company wind up To wind up a business in a company, a trustee may be appointed (either...