Keen to invest and not sure where to start? Posted on May 24, 2021

Many Australians are feeling confident in the current market to invest, and you may be keen to get involved. If you’re starting out as an investor, the amount of information can be a little overwhelming. This article will help you to gather some general background information about the different asset classes of cash, property, shares and risk management strategies so that you can take the next step in your goal to be better off.

Understanding asset classes

Most investments fit into one of four main categories or asset classes:

| Cash | Fixed Interest | Property | Shares |

| Cash includes money in bank accounts, as well as investments in bank bills and similar securities and some short term (up to 12 months) term deposits. Cash investments provide stable, low-risk income in the form of regular interest payments. | Fixed interest investments include term deposits, debentures, mortgages, and government and corporate bonds. The income return is usually in the form of regular interest payments for an agreed period of time. For fixed interest investments that are tradable (eg bonds), there is the potential for capital growth or decline depending on interest rate movements | You can invest in property directly (eg when you buy a house or commercial premises such as a shop or office) or indirectly (eg by purchasing units in a property trust that is listed on a stock exchange). This asset class includes residential, commercial, retail, hotel and industrial property. | A share represents part ownership of a company. Shares are generally bought and sold on a stock exchange. Returns usually include capital growth as well as income from dividends. You can choose to invest in Australian shares, global shares or a mix of both. |

| Time horizon: short term | Time horizon: one to three years | Time horizon: three to five years (medium term) | Time horizon: five to seven years (long term) |

The main asset classes can be separated into two broad groups – defensive and growth investments.

Risk vs return

As a general rule, the larger the potential investment return, the higher the investment risk and the longer you need to remain invested to reduce that risk. The amount of risk involved with an investment can be managed by matching it appropriately with the length of time you have available to invest and your tolerance towards volatility or fluctuations in returns.

Diversification

Another wise way of managing or reducing investment risk is through diversification. This is the strategy of investing your money across a range of different investments. The exact mix of investments you choose will depend on:

- your financial objectives

- the amount of time you have available to invest

- your personal tolerance for risk.

Diversification is important because every type of investment has its ups and downs. Owning a diverse range of investments can help you achieve smoother, more consistent investment returns. The more ways you diversify, the more you can reduce your risk. For example, you can invest:

- across different investment types or asset classes (cash, fixed interest, property, shares)

- in more than one investment within each type (eg invest in several different industries and companies when investing in shares)

- in more than one type of fund, and more than one fund manager, when investing in managed funds

- inside and outside of super.

Which asset classes are best for you?

When a financial adviser creates a financial plan, they use a number of factors to determine which combination of asset classes will work best for you. These factors include your attitude to risk, your investment time frame and your financial and lifestyle goals. The end result or how your money is invested across the different asset classes, is known as your ‘asset allocation’.

For example, if you are a risk-averse investor looking for stable returns or wanting a low-risk, short-term investment option for a sum of money (eg a home deposit) – your adviser would probably weight your asset allocation more heavily towards defensive investments such as cash and fixed interest.

On the other hand, if you are comfortable with short- term fluctuations in the value of your investments and want to invest for more than five years, growth investments such as Australian and international shares may be the best option for you.

If you are concerned that your asset allocation does not match your investment goals or attitude to risk, it’s important to review your financial plan with your financial adviser. They can adjust your asset allocation as required to help you achieve the best possible results.

Managing investment risk

If you invest in just one asset class and its value falls, the value of your investment will drop with it. However, by investing in several asset classes, you spread your risk and can offset underperformance in one asset class with positive performance in another. This could help you achieve smoother, more consistent returns over time.

Each asset class has its good and bad times, so while a diversified portfolio will never achieve the top return in any given year, it will never receive the lowest either.

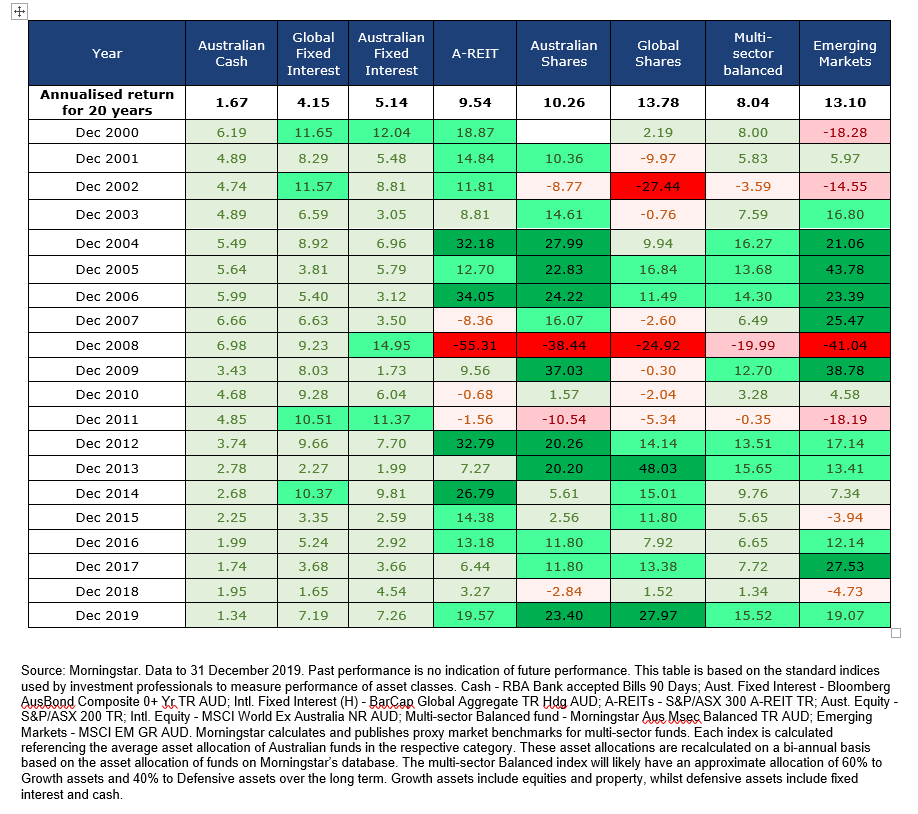

The table below shows annual returns for the different asset classes from 2000 to 2019. As you can see, the top performing asset class one year may deliver the poorest results the next. This highlights the importance of diversification as a method of managing risk.

Asset class returns (%)

Important information

AdviceCo ABN 85 136 858 190 is an Authorised Representative of Count Financial Limited ABN 19 001 974 625, AFSL 227232. This document has been prepared by Count Financial Limited ABN 19 001 974 625, AFSL 227232 (Count). Count is 85% owned by CountPlus Limited ACN 126 990 832 (CountPlus) and 15% owned by Count Member Firm Pty Ltd ACN 633 983 490. CountPlus is listed on the Australian Stock Exchange. Count Member Firm Pty Ltd is owned by Count Member Firm DT Pty Ltd ACN 633 956 073 which holds the assets under a discretionary trust for certain beneficiaries including potentially some corporate authorised representatives of Count Financial Ltd. ‘Count’ and Count Wealth Accountants® are trading names of Count. Count advisers are authorised representatives of Count. Information in this document is based on current regulatory requirements and laws, as at 1 July 2020, which may be subject to change. While care has been taken in the preparation of this document, no liability is accepted by Count, its related entities, agents and employees for any loss arising from reliance on this document. This document contains general advice. It does not take account of your individual objectives, financial situation or needs. Should you wish to opt out of receiving direct marketing material from your adviser, please notify your adviser by email, phone or by writing to us.