Federal Budget 2020 – What it means for you Posted on October 7, 2020

Budget night is always full of opinion and commentary, sometimes it can be difficult to identify the facts. We’ve cut through the noise to highlight the items that we think will affect your hip pocket…

Individuals:

Income tax cuts

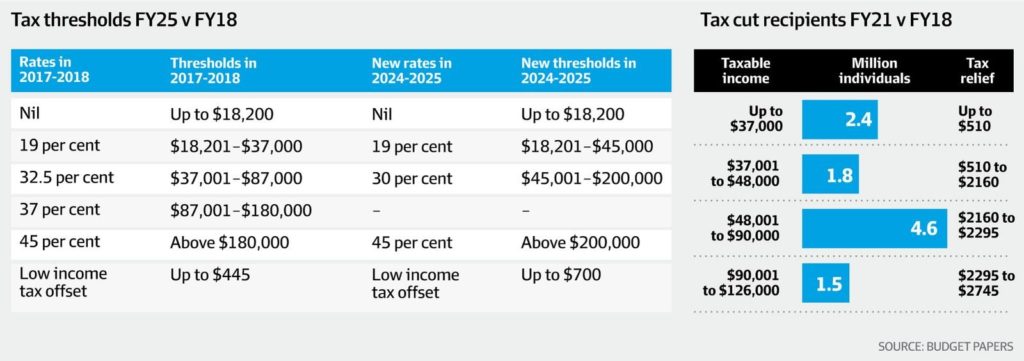

Low-and middle-income earners who earn below $180,000 will see a tax cut equaling between $500-$2,745 hit their bank accounts in a matter of weeks. See below table:

What you have to do – Nothing.

How soon? Pretty soon. The government has to pass it as legislation through parliament. It is unlikely to meet with any resistance from Labor. When it is passed by parliament, a new tax table will be released by the ATO and passed on to all accounting software companies who will automatically apply it to payroll calculations. The cuts will be back dated to 1 July 2020 and will last until 30 June 2021. The estimate is that the extra money should start reaching you via your payroll by early November 2020.

Businesses:

Instant Asset Write Off

Businesses with a turnover of up to $5 billion may deduct the full cost of eligible capital assets. Formerly capped at $150,000 until December 2020. For businesses with aggregated turnover of less than $50m this also applies to second hand assets up to $150,000.

What you have to do – Assess your investment plan as part of your business plan with your accountant.

How soon? The write-off now applies to all assets covered by existing depreciation rules purchased between 7.30pm last night and first used or installed by 30 June 2022.

Loss carry-back (or claw-back) scheme

Businesses will be able to claim back on last year’s profits. A business that was previously profitable, but is making a loss due to COVID-19 can claim some of the taxes they paid in the previous financial year.

What you have to do – Keep your BAS up to date and wait until it is passed through parliament, then work with your accountant to process your claim and access funds you are entitled to.

How soon? Unknown. The mechanic has not yet been announced, but as the intent of this scheme is to inject cash into businesses, we do not expect it to be too long delayed.

50% Wage subsidy for Apprenticeships and Trainees

Employers will be able to receive subsidies for 50% of the wages of a new or recommencing apprentice or trainee to the value of $7,000 a quarter, for the period until September 30, 2021. This builds on the wage subsidy scheme that was introduced during the Governments COVID-19 stimulus package back in March 2020.

What you need to do – You will need to complete an application for each Apprentice or Trainee you have employed since 1 July 2020 via an approved Australian Apprenticeship Support Network (AASN) provider or Group Training Organisation (GTO). You should contact us for support in this process.

How soon? The scheme is already underway.

JobMaker Hiring Credit for employing JobSeekers

Businesses that employ people below the age of 35 who are currently on JobSeeker government payments will be given a JobMaker hiring credit. The hiring credit will be paid at the rate of $200 a week for hiring people aged 16 to 29, or at $100 a week for 30- to 35-year-olds. Employees can receive this hiring credit for 12 months

What you need to do – Nothing as yet. More information will be shared on the application process by the government when legislation is passed through parliament.

How soon? The scheme will apply from Wednesday 7 October 2020.

The government will continue to support businesses through JobKeeper 2.0 until March 2021.

It is understandable that you may have questions about how to access government budget schemes so please don’t hesitate to book a meeting with us. We’re here to help.