How SMEs can stay on top of business Posted on April 23, 2022

The last two years have taught us all that the world is increasingly unpredictable. Business owners and managers have less control than ever, but there are two simple things businesses can do NOW to prepare for the next unpredictable event, and ultimately stay on top.

Risk management planning

By definition, risk is something that poses danger, harm or loss to your business. At their worst, risks shut businesses down, but thankfully, they don’t have to. Preparation and planning will enable you to respond fast, recover quickly and stay on top.

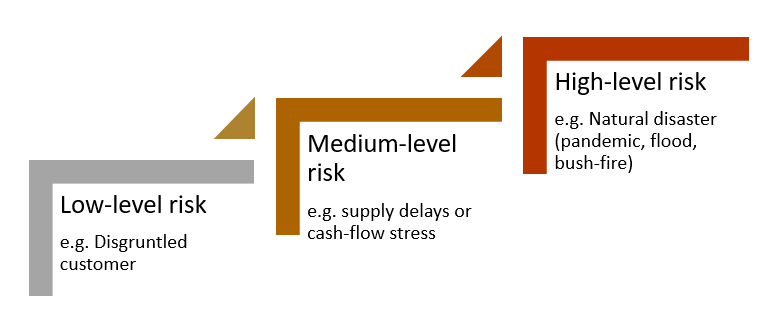

Naturally, you can’t plan for every risk. Who would have believed we’d have a pandemic before it actually happened, let alone a plan for it? But you can do a scalable plan based on the impact-level to your business. Here is an example…

Once you define your levels and input a few examples, you need to plan the steps you’d need take in response. This will highlight any gaps you have in your preparedness such as training, systems, security or insurances.

One of the biggest risks to face modern business is also one of its greatest opportunities: cyber systems. Cloud-based business commercial systems will undoubtedly save you time and money, as well as increase your accuracy and ensure compliance, however now is also the time to review your cyber security systems. The Australian Cyber Security Centre has issued an advisory urgently encouraging local organisations to boost their cyber security in light of rising international tensions with Russia. Be alert and seek professional advice, especially when it comes to your commercial software. We update our own systems regularly and can support businesses who need to take action. Please let us know if you require support with this.

Cash-flow planning

We know that cash-flow is the single biggest stress for business owners and the best protection is as simple (and complicated) as ‘plan, review, plan, repeat’. It is important to avoid doing it on your own. You need professional insight and a trusted partnership with your accountant to tailor advice to the specifics of your business, consider the busy and slow periods and when you should be spending and saving. Planning should ideally take place before tax time, and at regular intervals after that. The ATO is back in full collection mode and there are few businesses that could cope with being blind-sided by a big tax obligation. Cash-flow planning is both art and science – you bring the art, accountants bring the science.

If risk and cash-flow sound like something you need to get on top of, and would like to know more, join our complimentary business planning workshop on 11 May in Gosford where we aim to share our knowledge for your business control and confidence.