Market Update: Breaking point Posted on May 2, 2022

Article by BetaShares Exchange Traded Funds

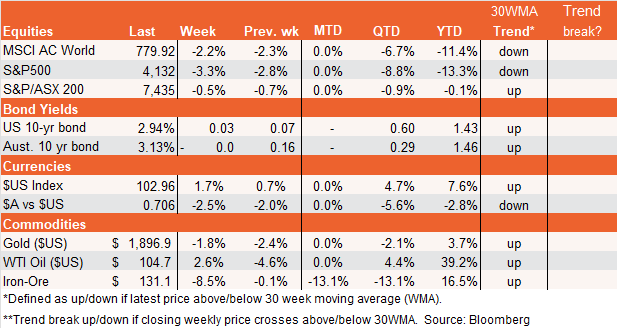

Global Markets

Mixed earnings reports, hot U.S. wage and price inflation, and the prospect of an aggressive U.S. Fed rate hike conspired to send global equities lower again last week. Of course, we can add to this worrying mix, renewed concerns over China’s economy due its harsh lockdowns and the raging war in Ukraine. While the U.S. earnings reporting season is overall still reasonable, what we are seeing is an unwinding of some of the COVID-related surge in profits and share prices by America’s glamorous tech stocks (such as Amazon and Netflix) which is only aggravating the downward pressure on this key growth sector caused by higher U.S. interest rates.

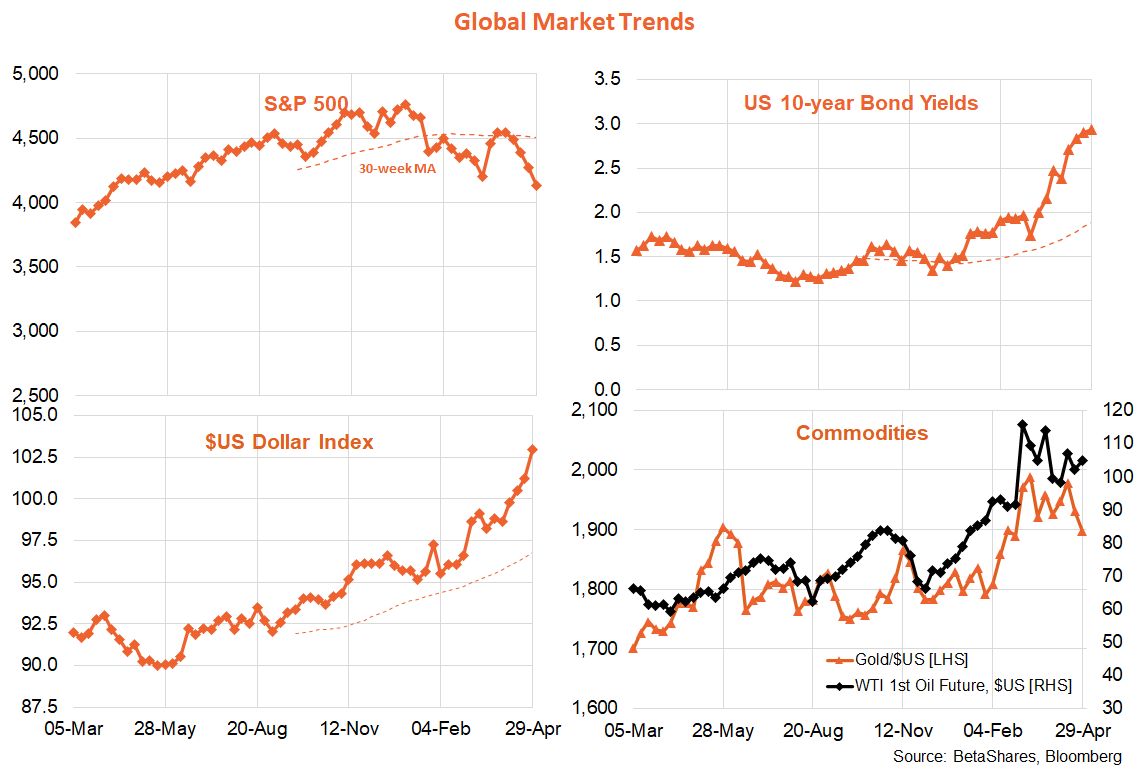

Despite ongoing aggressive interest rate hike expectations, gathering equity market weakness has seen longer-term bond yields stabilise somewhat in recent weeks, while oil prices have also pulled back. The $U.S. dollar, meanwhile, remains all conquering.

While last week’s U.S. inflation reports were high, they were no worse than expected. What did seemingly jar sentiment, however, was likely the higher than expected employment cost index, which rose 1.4% in the March quarter (market at 1.1%). This again highlighted the fact that the U.S. labour market is red hot and generating considerable inflation risk in its own right – above and beyond global supply side bottlenecks. In turn, that highlights that the U.S. economy does likely need to materially slow in the months ahead if it’s to have any chance of getting on top of its inflation problem. Equity markets appear to be finally waking up to this risk.

In terms of the week ahead, it is now all but certain the Fed will hike rates by 50 basis points at the conclusion of its two-day meeting on Wednesday. In fact, there may be a modest relief rally if the Fed avoids hiking by 75bps – which is now partly priced in the market. That said, another significant challenge will come on Friday with the April payrolls report. Employment is expected to grow by a solid 380k, the unemployment rate to edge lower to 3.5%, and annual growth in average hourly earnings to ease back to a (still high) 5.5% from 5.6%. Any blowout in hourly earnings would be especially challenging for the market.

All this is consistent with my view of late last year – following the Fed’s hawkish pivot – that U.S. bond yields would be heading higher and equity markets (even without a U.S. recession) face a considerable risk of a correction of up to 20%.

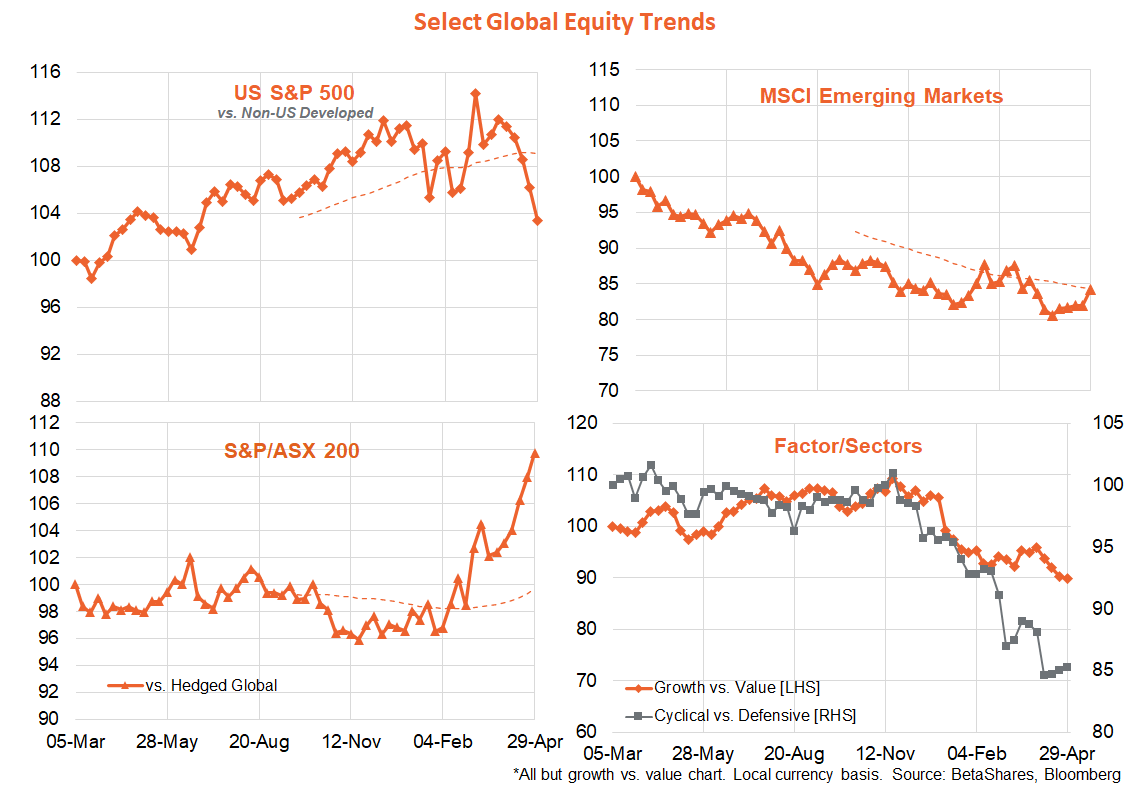

As evident in the charts below, U.S. equity market outperformance in developed markets has taken a more notable hit in recent weeks, much to the benefit of countries such as Australia. The emerging markets grouping is trying to gain ground, but the move so far is unconvincing while the growth factor in general continues to underperform value.

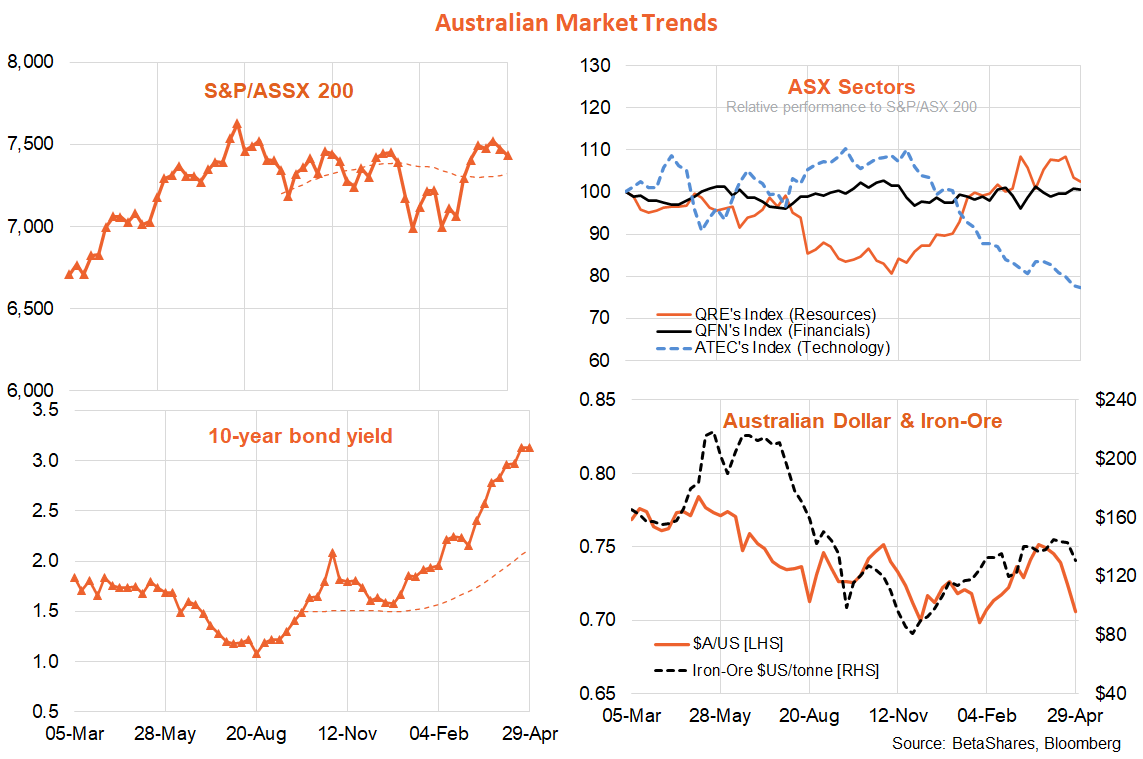

Australian Wrap

The S&P/ASX 200 slipped back for the 2nd week in a row reflecting ongoing weakness in the U.S. market. As evident in the chart below, the local market tried and (so far at least) failed to break above recent highs of 7,500, and the outlook appears to be further sideways to downward market movement as investors confront monetary policy tightening in both Australia and the United States.

Recent market weakness has reflected persistent trend weakness in growth areas such as technology, though there’s also been a pull back in the resources sector in recent weeks due to a drop back in iron-ore prices and concerns over China’s growth outlook due to renewed lockdowns as part of its zero-COVID approach. The financial sector, meanwhile, is still holding up reasonably well.

Indeed, the Australian market has nicely outperformed global markets so far this year, though our lower weight to the beaten up technology sector is not the main driver – instead it’s been stronger performance by our financial and materials sectors. In turn, that reflects the ongoing strength in our local economy and global commodity prices. Australia’s information technology sector has actually fallen harder than its global counter part over the past six months (-28.9% vs -14.8%).

Last week’s local highlight was of course the higher than expected consumer price index report, which now all but assures the RBA will hike rates tomorrow. As regular readers will know, I predicted a RBA rate hike last Tuesday – ahead of the CPI result and most other economists – on the basis that even if only in line with expectations, the high inflation reading should easily justify a hike, without needing to wait for next month’s also important wage numbers.

As it turned out, the high CPI reading (annual trimmed mean inflation rising to 3.7%) now makes that call easier – though it remains to be seen whether the RBA will still hesitate, either due to election sensitivity or because it really does want to wait for confirmation of also accelerating wage inflation before acting. To my mind, if the RBA does raise rates tomorrow, it should and likely will be only 15bps – it does not need to shock the economy with a 40bps move straight off the bat.