Safe as Houses? The Sequel Posted on April 14, 2022

Article by AllianceBernstein

In our 2017 article “ Safe as Houses? Don’t Bet on it.” we argued that Australian house prices can and do fall. With the Westpac-Institute of Melbourne Time-to-Buy a dwelling index at lows not seen since the GFC, it’s a good time to revisit that analysis.

House prices up 20 to 30% in all corners of the country. The prospect of rising mortgage rates should have us all worried. However, in our view this cycle is likely to look much like previous cycles. That is, prices should decline, but we’ve been here before.

It’s not as hot as it seems

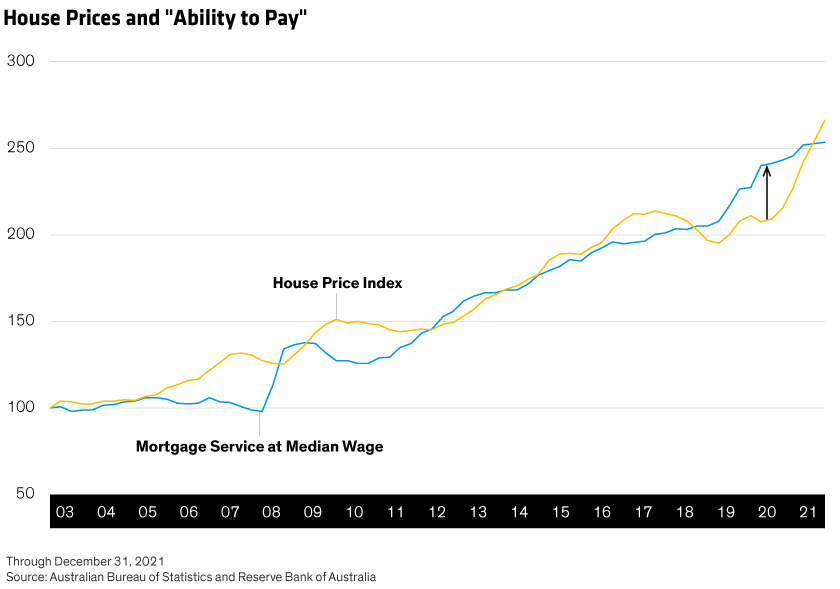

The primary basis for this “hopeful pessimism” is affordability. The price of housing is ultimately a function of a buyer’s ability to pay. This is a simple function of income and mortgage rates. Figure 1 shows the relationship between average house prices and ability to pay.

An important observation from this analysis is going into the COVID lockdowns the market was due for a big catchup. The period from 2017 to 2019 was the worst period in the last 20 years due largely to purchase and lending restrictions imposed by FIRB, APRA and ASIC capped off by the Banking Royal Commission. Ending these restrictions ushered in the next boom.

And, there are still tailwinds

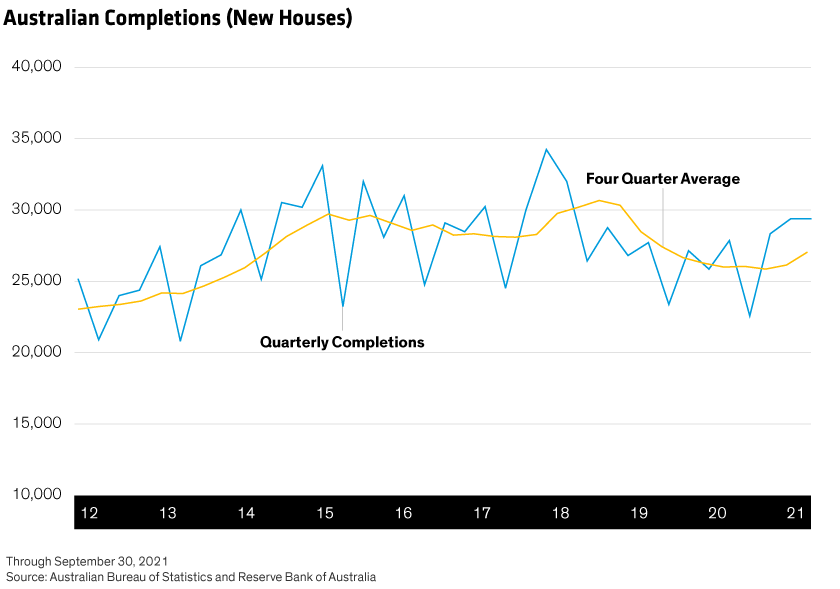

There are also a number of positive factors that should, on balance, support prices. Although hard to quantify, COVID lockdowns have amplified the desire for personal living space. This will continue to persist in a hybrid work-from home environment. And, on the supply side we’ve had a below average period of housing construction. This kicked off with low approvals in 2018-19 and continued through the slow construction period of lockdown. Display illustrates a period of subdued new house completions. Rising rents, up ~9% this year according to CoreLogic, illustrate the tightness in the market for accommodation. Fortunately, this lack of supply has come at a time of low immigration. We now expect immigration to rise dramatically.

But, rising mortgage rates will eventually bite

At a national level our analysis show house prices are ~5% overvalued compared to their 20 year average. However, a 1% increase in mortgage rates would dent affordability by a further 9%. This suggests a period of modest price decline to allow wages to catch up.

And, as always, this will vary by market. Some, markets, like Perth, are well off their previous highs and less fragile. Sydney, in contrast, has had a blistering year and is already showing price declines. We are particularly concerned about regional markets, which are up 30% on the year largely due to the COVID sea and tree-changers. As the country moves toward a work-from-work model these markets may be more affected.

Gates Moss is Senior Research Analyst and Portfolio Manager—Australian Equities

This document has been prepared by AllianceBernstein Australia Limited (“ABAL”)—ABN 53 095 022 718,