Market Update: Volatile commodoties | Turmoil takes toll | Gold back in vogue Posted on March 14, 2022

Article by Perpetual

The Perpetual Weekly briefing is a summary of discussions our team has had over the course of the week regarding key investment themes, markets and stocks.

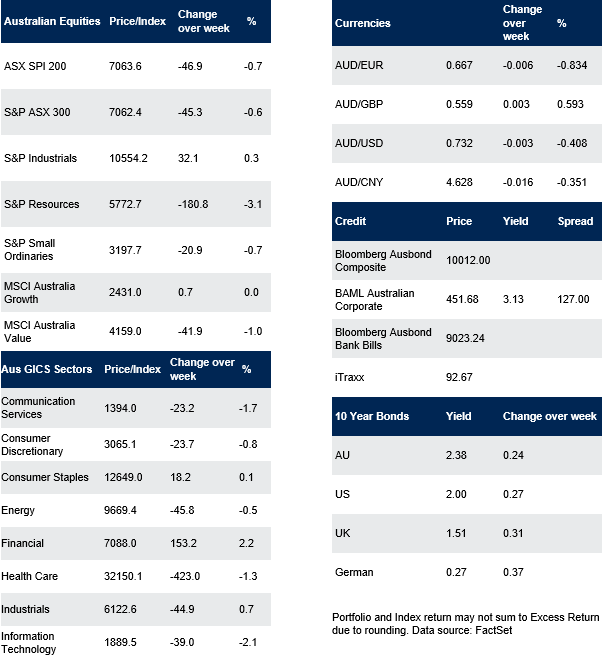

Commodity markets don’t know which direction to take. Volatility in commodities saw prices first surge before being dragged lower by double digit moves in oil prices. Oil prices dropped in a sudden move on Wednesday, giving back some of the rally this month amid confusion over supply disruptions stemming from Russia’s invasion of Ukraine. The US marker for crude oil, West Texas Intermediate (WTI), tumbled more than 12% to trade at $US108.70 a barrel at one stage – after WTI briefly topped $US130 a barrel — a 13-year high. WTI was trading up around $US110 by the end of the week. Brent crude, the international benchmark, lost around 13% to $US111. Brent had hit $US139 on Monday, its highest since 2008 and was back above $US112 a barrel in Asia on Thursday. The weakness in oil prices came amid indications of possible progress by the US in encouraging more oil production from other producers. Whilst this sounds promising, and oil prices are highly elastic to demand and supply changes, we think pressure will remain. Nickel was hit on the LME by a spectacular short squeeze. None of this bodes well for economies and markets seeking to overcome supply side dislocation.

Turmoil is taking a toll. The University of Michigan found US consumer confidence took another hit, declining to fresh 11-year lows. Respondents said personal finances were expected to worsen in the year ahead by the largest proportion since the surveys started in the mid-1940s. Ukraine was widely cited. Year on year, CPI hit 7.9%, a fresh 40 year high. Equity markets tanked again late Friday with the US S&P500 down -1.3% and the NASDAQ down -2.2%. The US 10-year yield returned to near 2% after weakness in the first few days of March. Speculation that the Fed will begin the tightening cycle on Wednesday with a 25 bp hike was widespread.

Stock in focus: Newcrest Mining. Newcrest has been our preferred gold stock and it was encouraging to see it recover strongly from a dip in late January when the stock fell 15% in a single week. Our favourable position is partly off the back of Newcrest’s earnings growth and ROE, but also underpinned by its high earnings retention and the efficient management team it has in place. We also like the recent acquisition of Canadian miner Pretivm and its Brucejack gold mine, which will bolster Newcrest’s gold production profile. However, as a gold miner, there are few things that affect the valuation of Newcrest more than the gold price itself. Gold equities also generally offer additional operational leverage to the gold price. And with the precious metal topping US$2,000 an ounce last week and with no clear visibility over how things end in Ukraine or the path of inflation, we feel there is value given to be had. Where we can’t buy gold or energy to protect against these risks, we own companies with pricing power (Brambles), companies with pass-through pricing (Orora) or no operational risk (Deterra).

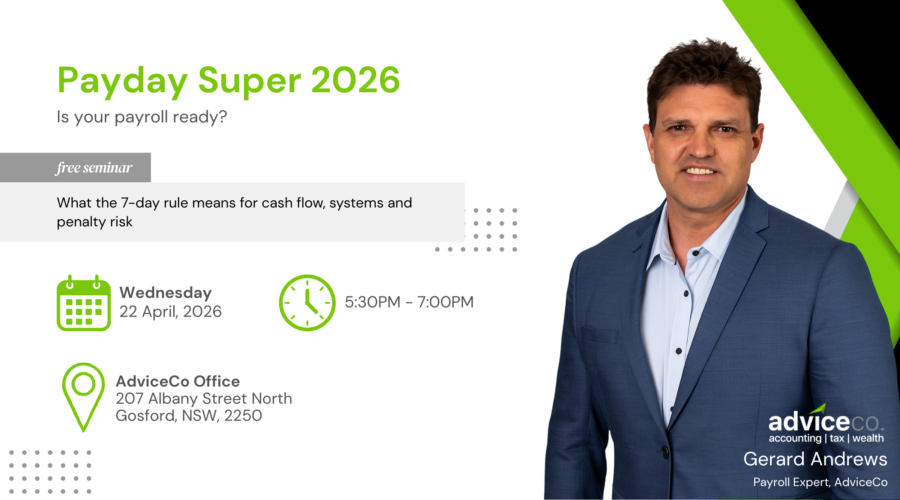

Perpetual Listed Investment Offerings

Indices as of week ending 11th March 2022 in local markets