Market Update: QSML – Quality comes in small packages Posted on October 6, 2022

Article by Vaneck

In brief

- While the markets watch on central banks do all they can to fight inflation, astute investors are readying themselves for the opportunities.

- Market falls have been disparate and heterogeneous within asset class returns across sectors and styles.

- The Fed is bracing for a ‘soft-ish landing’ on a narrow runway, but the market appears to be readying itself for a ‘hard landing’, that is when an economy enters recession after an interest rate hiking cycle.

- Manoeuvring portfolios to meet the challenges and idiosyncrasies of these capital markets is no easy feat.

- Navigating the world of investment opportunities through Smart Beta ETFs has empowered advisers and investors to build robust portfolios and target outcomes.

- The Quality Factor, inspired by investment pioneers such as Benjamin Graham and Warren Buffett, has demonstrated its prowess through the cycle with the VanEck MSCI International Quality ETF (QUAL) has historically provided superior risk-adjusted performance and an enviable track record relative to active managers, all for a fraction of the cost and with full transparency (industry endorsements include: Lonsec – Highly RecommendedIndex, Zenith – Recommended & Morningstar – Silver).

- Savvy investors are reassessing portfolios and preparing for the next cycle following a hard landing, which leads to low growth and a period of recovery, as in the past, during this type of cycle, small-caps have offered more upside than large caps because they have fallen further in the market downturn.

- Australian advisers are no strangers to Australian small companies but the world is far bigger than the ‘Small Ords’. The international small-cap universe presents over 4,000 companies and, as size is a relative term, many of these companies are not that small.

- As renowned American financier Bernard Baruch noted, “Some people boast of selling at the top of the market and buying at the bottom– I don’t believe this can be done except by latter-day Munchausens.”

- It may be worth preparing portfolios for a recovery and extending on the Quality Factor, via the VanEck MSCI International Small Companies Quality ETF (QSML) which is the only smart beta international small-cap ETF in Australia.

- For large trade orders please contact Capital Markets desk on 02 8038 3317.

Central bankers in high-wire act

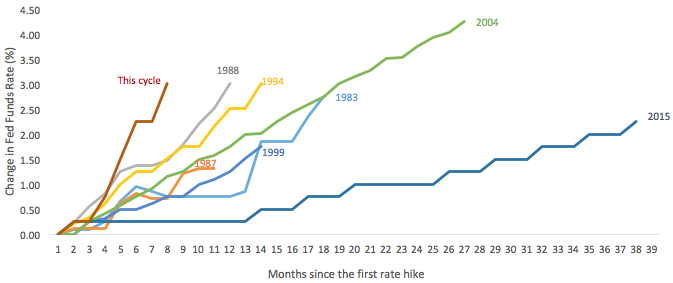

The Fed has never raised rates as steeply as it has since it started hiking in March.

Chart 1: This is the fastest rate hiking cycle in over three decades

Notwithstanding the bear market bounce in July, the market has been on a downward trend since, in reference to ‘transitory’, the Fed declared at the end of last November “it was probably a good time to retire that word.”

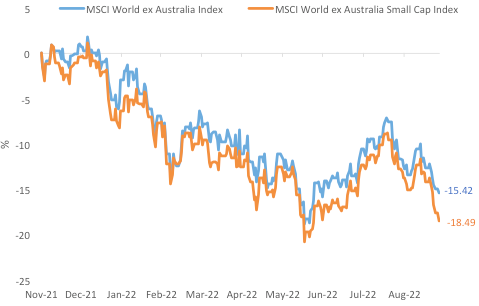

Globally, small- and mid-sized companies have been hit more than their large cap counterparts.

Chart 2: Global large- and small-cap performance 30 November 2021 to 26 September 2022

Savvy investors are starting to prepare their portfolios to navigate through potential growth/recovery setbacks such as a hard landing, geopolitical tensions and poor economic data.

One of the beneficiaries could potentially be international small companies and as according to Frank Martin, “Since the ‘bottom’ is only declared in retrospect, those who wait for it almost always go away empty-handed,” it could be time to start considering your client’s portfolios. We are not saying now is the time to go all in, but by layering in, or dollar cost averaging, savvy investors ensure they are part of any recovery that eventuates.

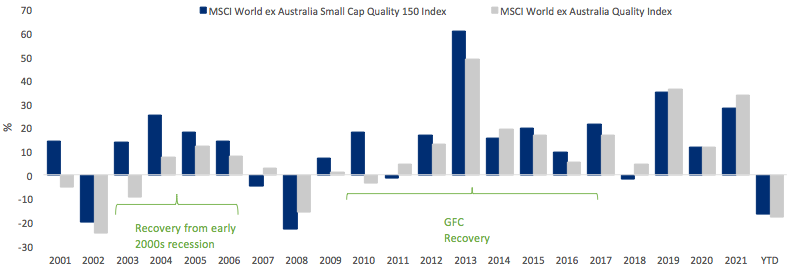

Quality factor in recoveries

Figure 1 below shows that international quality small-cap stocks, as represented by the MSCI World ex Australia Small Cap Quality 150 Index (QSML Index), has fallen less than the fall of the large- and mid-cap MSCI World ex Australia Quality Index so far in 2022. International quality small-cap companies also did well in previous recoveries following: 1) the global slowdown in the early part of the century following the dotcom bubble; and 2) for many of the low-growth years following the GFC.

Chart 3: Calendar year performance: MSCI World ex Australia Small Cap Quality 150 Index and MSCI World ex Australia Quality Index

Both of these periods coincide with periods following a US recession (2001 & 2007 to 2009). There is a fear that the US is headed for a recession again, as the Fed tightens rates.

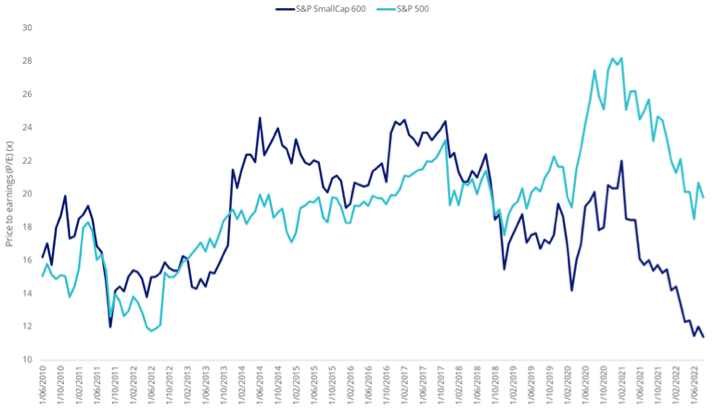

Small caps in the US, for example, are now as cheap relative to large caps, as they have been in over 12 years. Additionally, they are at their lowest valuations in over 12 years.

Chart 4: Price to equity (P/E) of S&P 500 and S&P SmallCap 600

But as you know, with small companies investing, it pays to be prudent. The international benchmark, like the S&P/ASX Small Ordinaries, includes companies that are not attractive from an investment point of view, it also includes in excess of 4,000 companies. The same issue is true when you consider an international mid- and large- cap passive approach; not all of the 1,500 plus in the MSCI World ex Australia Universe are attractive from an investable point of view.

Quality is a factor approach that has shown historical outperformance in the mid- and large-cap universe. Australian investors have experienced this with the VanEck MSCI International Quality ETF (QUAL). It is worth noting that past performance is by no means a reliable indicator of future performance.

The VanEck MSCI International Small Companies Quality ETF that trades under the ASX ticker ‘QSML’ is a diversified, international small companies quality portfolio. QSML tracks the MSCI World ex Australia Small Cap Quality 150 Index (QSML Index) and may be used by investors looking to take advantage of a global recovery in a slow growth/post-recession environment.

Key points of QSML

- 150 of the world’s highest quality small companies

Access a diversified portfolio containing some of the world’s highest quality small companies based on key fundamentals including (i) high return on equity, (ii) earnings stability and (iii) low financial leverage. - Outperformance potential in growing companies

Investments focusing on quality small companies that have delivered outperformance over the long term relative to other global small companies benchmarks and also relative to large- and mid-cap benchmarks. - Diversified across countries, sectors and companies

Offering investors a portfolio of 150 companies across a range of geographies, sectors and economies.

Click here to download a copy of Finding the pawns that will become Queens: A guide to international small companies investing. In summary, the paper finds that the Quality Factor is more pronounced in international small companies than international large-and mid-companies.

Key risks: An investment in the ETF carries risks associated with ASX trading time differences, financial markets generally, individual company management, industry sectors, foreign currency, country or sector concentration, political, regulatory and tax risks, fund operations, liquidity and tracking an index. See the PDS for details.