Market Update: New dimension of risk in markets Posted on February 25, 2022

Article by Vanguard

Geopolitical & market impact commentary

A new dimension of risk has entered the financial markets with heightened tensions in Ukraine. It’s not something the markets needed when they were already dealing with brisk inflation and preparing for an expected cycle of interest rate hikes from most of the world’s central banks.

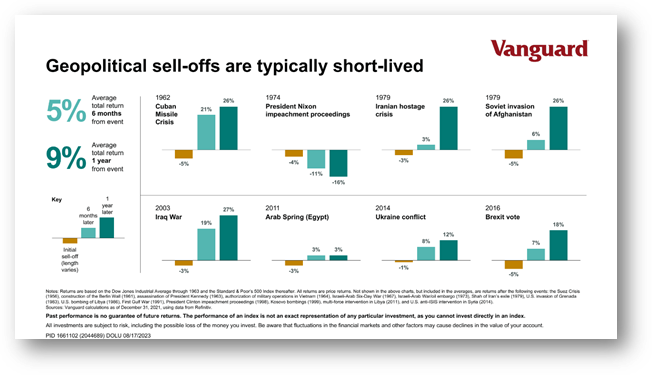

We know this, however, about equity markets in the context of geopolitical risks: they’ve been resilient, much as markets have always been resilient in the face of various risks. We expect the markets to work themselves out, reaching new heights over time and at varying paces. These rises will sometimes be punctuated by sharp declines. This is how it works. For context, the below chart shows the response of markets to some previous crisis.

So now is not the time to give up your fortitude. Now is the time to take it all in with a deep breath, knowing that this day would come—and knowing that it will pass. I wish I could tell you when it will pass. That, unfortunately, is not how it works.

In the meantime, if the markets throw your mix of stocks and bonds out of kilter, you may have a good opportunity to restore them to your desired state. Rebalancing is a useful strategy for ensuring that your asset allocation continues to suit your goals.

To understand more about Vanguard’s Economic and Market outlook for 2022 and beyond, read our see our full report or summary report here.

Diversified Fund Performance

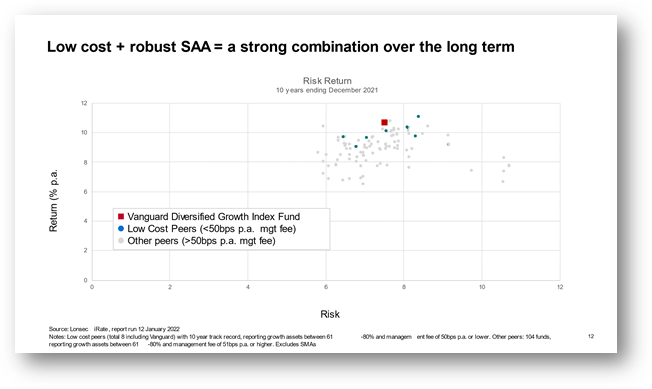

Over the long term, controlling what you can control (the amount of risk you want to take and the fees you pay), contributes to a strong overall outcome, especially relative to peers who may choose to switch in and out of asset classes and underlying managers along the way. These changes can have an impact on shorter term numbers if a manger happens to get it right. However, it is very difficult to make the right move in every single scenario.

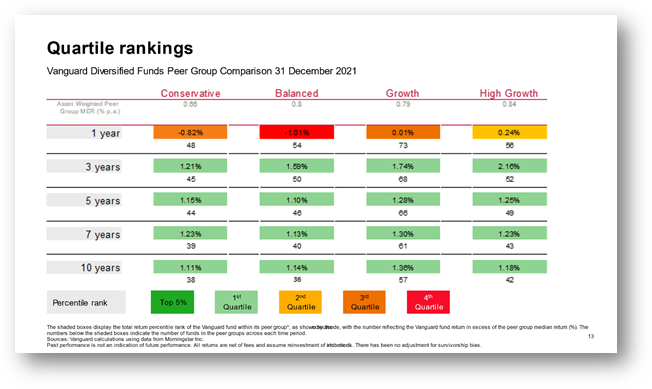

While longer term return outcomes continue to be strong, the shorter-term numbers for the Vanguard Diversified Funds have dipped into the third quartile when viewed to end December 2021 (see below) which has triggered some questions from clients.

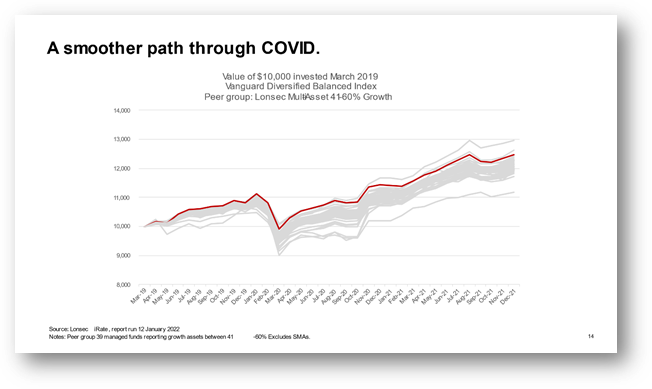

This is largely because Vanguard holds more exposure to higher quality and higher duration fixed income than many peers who held cash or riskier credit. High quality long duration fixed interest brings portfolio diversification benefits over and is a much lower volatility asset class than equities (which are the engine room of diversified fund returns). As a reminder, holding fixed income (which act as a ballast), resulted in a smoother path through the volatility in March 2020.

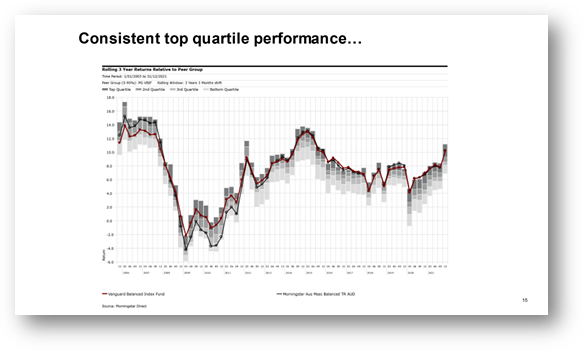

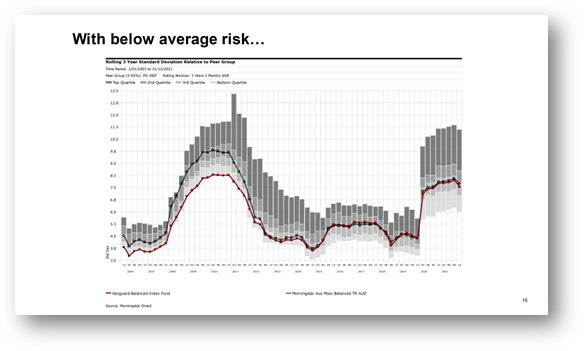

Also, over the rolling three-year time period we are consistently top or second quartile, with lower than average risk.

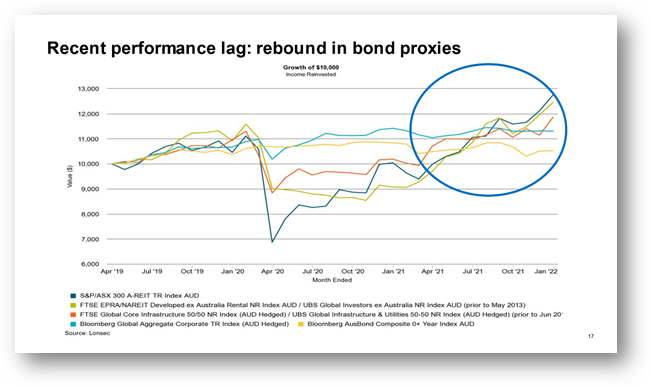

The reason that peers have outpaced the Vanguard diversified funds is that they have benefited from the rebound in riskier bond proxies and credit strategies (shown in orange, lime green and dark green), which coincided with a recalibration of inflation and interest rate expectations in the bond market (and a dip in capital price), shown in the yellow and aqua lines below.

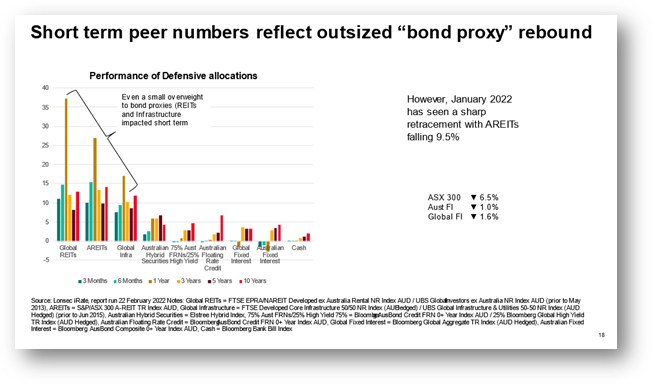

Even a very small exposure to bond proxies such as Australian and Global REITs and Infrastructure has delivered outsized performance over the 12 months ending December 2021 (a 1% overweight to AREITs delivered more than 3% contribution to return). This has begun to correct in January 2022 as AREITs underperformed both bond and equity markets, falling 9.5%. We consider bond proxies to be more equity like in terms of risk (at times exhibiting more volatility than equities) and do not consider they offer sufficient return for the risk or diversification benefit over the longer term.

Meanwhile, despite the short-term dip in bond prices, the rise in yields has improved the forward-looking, longer term returns from traditional bonds.

I sometimes liken it to term deposits to explain the concept.

Say you visited the bank a year ago and the 3-year Term Deposit rates were 0.30%.

If you went back today and the rates for 3-year Term Deposits were 1% you would:

- Be happy that Term Deposit rates have gone up because you have some money to invest and rates have improved

- Be a little disappointed that the TD you locked in a year ago at 0.30%, now seems less of a good deal

Term deposits are not repriced daily in the same way that bonds are, so bonds are merely reflecting the ‘disappointment effect’ in their pricing.

In neither case is there any issue that you won’t get your principal returned at the end of the 3 years so the negative returns are not a permanent loss of capital – just a change in the markets expectations about what interest rates will do in the future.

The Vanguard Fixed Interest Portfolios are like a giant collection of term deposits (except they invest in tradeable debt instruments called bonds). Every day cash comes in and is reinvested in bonds of varying maturities (a very small portfolio is shown as an example below).