Market Update: Australian Equities Update Posted on March 3, 2022

Article by Perpetual

Volatile markets continue

Equity markets are experiencing significant volatility. Even before the shocking events in Ukraine took place last week equity markets had been grappling with the prospect of rising interest rates to contain high levels of inflation.

Although Ukraine will focus minds on the short term, we believe the issue of inflation and interest rates will ultimately come back into focus should the events in Europe subside. Indeed, the consequences of the invasion of Ukraine are likely to exacerbate pre-existing inflation and supply chain woes.

Despite the challenges and uncertainty in markets over the last month, quarter and year, we remain consistent in our investment approach. The outcome of this can be seen in the performance after fees as at 28 February 2022 of our Australian Equities Funds available here.

We are stock-pickers, not macro investors, but we must be aware of the geopolitical risks that can impact our portfolios. Below are some reflections on the recent reporting season as well as the myriad of challenges, including Ukraine, that we believe investors need to consider in coming weeks and months and how we are positioned to best manage them for our clients.

Ukraine invasion shakes confidence

After the recent shakeout in equities from rate rise fears the invasion of Ukraine has further shaken confidence. The immediate effects are obvious. The shock of war will have a negative effect on confidence and economic activity, mainly in Europe. This will ripple, to varying degrees, out to the world. Sanctions have an even bigger potential to disrupt capital movement and key resources, especially Russian energy production. A rising global oil price acts like a tax or interest rate hike on the global economy. The financial sanctions, especially the exclusion of Russia from the SWIFT global payments system, including its central bank, will bite certain sectors hard. Already the Russian stock market and ruble have been crushed.

But where to from here?

The real question is “what does Putin want?”. Just days ago, many experts were saying that Putin didn’t want a war at all, he was just posturing for a security deal. Clearly, they were wrong. We assume nobody really knows exactly what Putin wants, maybe not even Putin himself as circumstances change. But his biggest concern before the invasion was Ukraine’s increasingly close ties with Europe. He sees Ukraine as part of Greater Russia and an important and historically (and buffer state) against security threats from the west which have endangered Russia over many centuries. Russia has always worried about its vulnerability in the west to an attack across the Great European Plain. Sweden (1605), Poland (1707), France (1812) and Germany (1941) have all invaded Russia this way.

Regardless of whether he aims to occupy Ukraine (which would be costly and dangerous), replace the government (to make it more Russia friendly) or peel off more land in eastern Europe (to add to and buttress recent acquisitions like Crimea) the military intervention was clearly designed to crystallise some or all of these goals.

Whether the war is quick and decisive or protracted is simply unknown.

The only thing we really know for certain, and probably the only thing truly important for investors, is that sanctions are the toughest ever imposed on a country and are likely to be in place for the foreseeable future. We think this ensures Russian resources, both physical and financial, will be constrained in supply and more expensive for longer. This all adds to the existing supply chain and inflation problem that besets the global economy.

Australian equities still a good place to be during this time

By and large Australian equities offer some natural protection for investors. We are far removed from the events of Ukraine itself. The Australian economy is also in much better shape than most of the rest of the world, having avoided the worst of COVID over the past two years. Employment has held up well (reaching all-time highs) and household balance sheets are generally in good shape despite elevated mortgage debt. Business confidence is beginning to build again. Inflation, whilst a significant problem in the US and Europe, has been more contained here. But it will rise.

There is always risk of some unexpected “contagion”, like unknown Russian financial exposures, although these are likely to be more of a problem in Europe, not Australia.

Whilst we have had better GDP growth than peers, we are not yet as pressed to raise interest rates as other countries, although these pressures will emerge at the latter end of 2022 as the Chinese economy shows signs of a robust recovery in H2 2022. Indeed, China’s recovery highlights the multiple growth engines that continue to support Australia’s economy into 2023.

Events in Ukraine, insofar as they elevate commodity prices, probably benefit Australia more than any of the negatives in the short to medium term. Whilst all of these factors could combine to put upward pressure on rates in 2023 as always, our debt filters continue to keep us out of companies that have excess leverage.

Market rotation likely to continue

Although markets rallied hard at the end of last week, including tech stocks, we thought this was premature given the number of challenges facing the markets. The immediate catalyst for the rally was that sanctions were not as bad as feared, although this preceded the weekend decision to remove Russia from SWIFT.

Already there is speculation that the interest rate cycle may be more muted than previously flagged. We think it’s too early to reach this conclusion, especially if the Ukraine crisis exacerbates supply chain and inflation woes.

Additionally, interest rate hikes do not need to be as rapid as previous cycles to have a significant impact on markets given the elevated levels of debt since the beginning of COVID. In the US excessive levels of corporate debt, has swelled significantly in the last two years. In Australia household debt has grown to new records and any rate rises will have an outsized impact on long duration assets, including bonds and growth stocks.

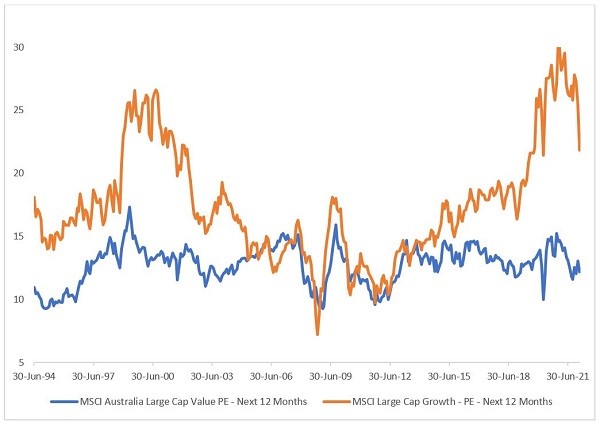

Whilst the bubble in Australian growth stocks is deflating, as depicted in the chart below, growth P/Es ratios are yet to fully normalise. Whilst large cap growth stocks like CSL have derated from their peaks, they remain on abnormally high valuations.

Source: FactSet

We continue to believe that most of the forces underway, from inflation and rising rates to structural demand for EV mineral components all continue to favour a rotation away from growth towards value-oriented stocks. We continue to find a significant number of quality businesses at discount valuations for our clients in this environment.

Reporting season shines through for Perpetual

Reporting season has generally been favourable with most companies reporting better than expected results. We felt it was the quality of our core holdings that held strong against market conditions in the last month. Some examples of theses core holdings that significantly outpaced the broader market were:

IAG delivered. On 11 February IAG reported H1 cash earnings $176m vs consensus $170.3m. Gross Premiums Written also exceeded consensus and the company reaffirmed margin guidance. Then on 22 February general insurers, including IAG, largely won a vital test case as the Federal Court largely rejected business interruption insurance claim related to the pandemic. We think there is a lot more potential upside as the stock continues to trade at the lower end of its historic range.

Event Hospitality & Entertainment continued to recover and reported H1 NPAT of A$33.3M vs year-ago (A$60.2M) on sharply improved revenues and a strong outlook for H2. The board expected that dividends would resume in calendar 2022. We have long extolled the quality of Events assets and conservative management. The stock continues to trade at a small premium to its property asset backing and offers investors exposure to rising experiential consumer demand as omicron continues to fade from view.

Santos results were broadly in line with expectations and bumper in prices, although the opportunity with Australia’s biggest oil and gas producer is through consolidation post its merger with Oil Search. We see opportunities for investors with the CEO flagging $4.2 billion in asset sales to help fund some projects, generate steady production, lower gearing from 35% to 25% and lift shareholder returns. We see the potential for higher dividends and / or share buybacks to help drive this.