Market Update Posted on November 2, 2020

US elections and daily pandemic updates, are dominating the news headlines. With this constant flow of information, investors must be focused on their long-term goals and learn to tune out the noise of the crowd.

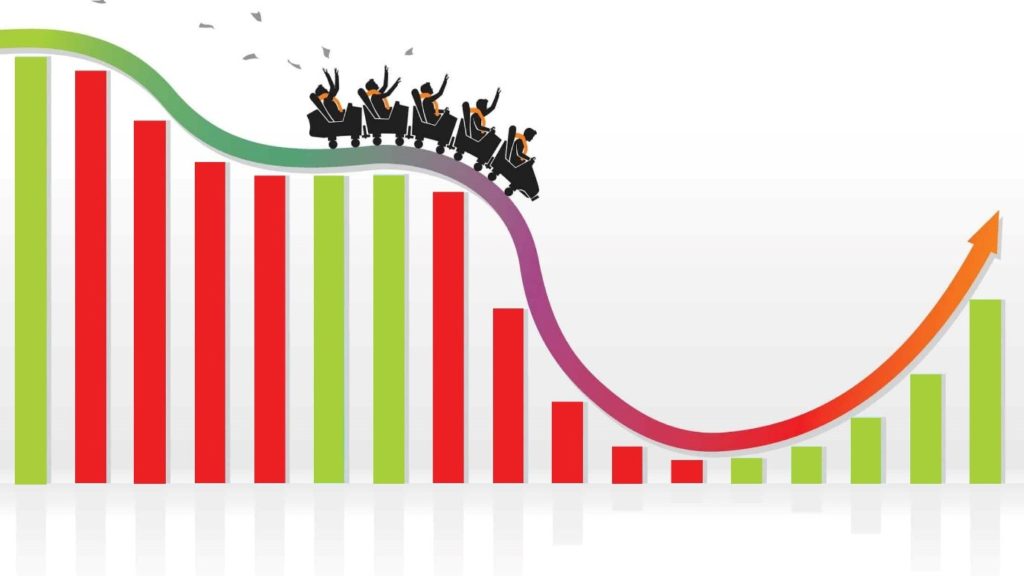

Following the sharp falls in February and rebound in March, the markets have been fluctuating daily mostly in a positive direction.

In recent days, you will have noted falls in the US market, and this is expected to continue. So, it may be time to “buckle up” as it could be a “wild ride” in the short to medium term.

According to Lonsec, an independent research house:

‘Markets don’t like uncertainty. True to label in the current environment, markets have been range-trading as significant uncertainty surrounds the outcome of the US elections, as well as the size and scope of a US fiscal package, which requires an agreement with Congress. Add to this ongoing concerns over the pandemic, especially in the US and Europe, and the fraught process of reopening, which has seen mixed success globally.’

In this low yield world, growth is important, and it is sensible to maintain an exposure to these assets such as equities, particularly as interest rates remain so low.

If you are relying on income from your investments, it is critical to make sure you have enough cash and low risk investments, in your portfolio, so you can maintain your investments.