JobKeeper – Changes and eligibility beyond September Posted on August 11, 2020

First, we heard that JobKeeper would be extended beyond 27 September 2020 to 28 March 2021. This has been dubbed JobKeeper 2.0 and included some changes from the original format. Then we heard that the format was revised in response to the COVID-19 crisis in Victoria. Here is what you need to know from Treasury about what’s changed, what hasn’t, and more importantly, what you need to do…

What’s changed:

- The payment rate and assessment of eligible employees by hours worked:

- From 28 September 2020, eligible employees who worked more than 20 hours per week will get a reduced payment support rate from $1,500 per fortnight to $1,200 per fortnight. From 4 January 2021, it will change again to $1,000 per fortnight. This is to help businesses wean off the support program.

- From 28 September 2020, eligible employees who worked less than 20 hours per week will have their support rate reduced from $1,500 per fortnight to $750 per fortnight. From 4 January 2021, it will reduce again to $650 per fortnight.

NEW! The date of employee commencement that deems an employee eligible has changed.

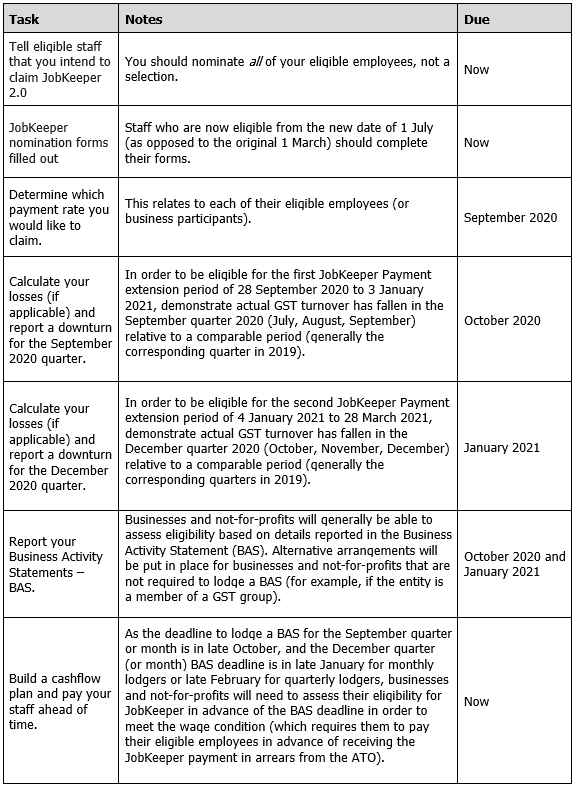

Within the rules of JobKeeper 1.0, the conditions of an eligible employee were that they must have been employed since 1 March 2020. As of 3 August, an employee is now eligible if they have been employed since 1 July. 1 March employees are still eligible. The change has been introduced to support businesses who may have new employees, and Australian workers who may have a new job after having ceased employment before 1 July. Remember, employers must nominate all eligible employees, not a selection (see checklist below).

URGENT ACTION – see checklist below and ensure all employees who are now eligible because of this change have completed their JobKeeper Nomination Forms and that you have paid them ahead of the period for which you intend to claim.

What hasn’t changed:

- Business decline in turnover test:

- 50 per cent for those with an aggregated turnover of more than $1 billion;

- 30 per cent for those with an aggregated turnover of $1 billion or less; or

- 15 per cent for Australian Charities and Not-for-profits Commission-registered charities (excluding schools and universities).

- The definition of an eligible employee:

- An individual is an eligible employee of an entity for a fortnight if:

- They have been employed by you since 1 July 2020 and are either full time or fixed-term, or a long-term casual employee and not a permanent employee of another business.

- Are 18 years or older since 1 July 2020 or, financially independent at 16 or 17 years of age and not studying full time.

- Were an Australian resident since 1 July 2020

- Are not receiving government parental leave or Dad and Partner Pay or a recipient of particular types of workers compensation.

- Casual employees are only eligible if they were employed by you on a regular and systematic basis for at least a year at 1 July 2020.

- An individual is an eligible employee of an entity for a fortnight if:

What you need to do – checklist:

ACTION: It is imperative for all businesses to build out their post-September business plan, whether it is inclusive or exclusive of JobKeeper. Please make a booking with your Account Manager to ensure your responses and actions are considered and beneficial. We are dedicated to helping businesses to stay as healthy as they can through COVID-19.

For those not already working with us, Steve Walker is our resident JobKeeper specialist. He has developed intimate knowledge of the recent changes introduced by the Federal, State and Local governments in response to COVID-19 and can navigate the legislation that is relevant to you so that you receive what you’re entitled to, and only pay what you have to. You can contact Steve with your questions: steve.w@adviceco.com.au