How your age will influence the contents of your Financial Plan Posted on February 19, 2022

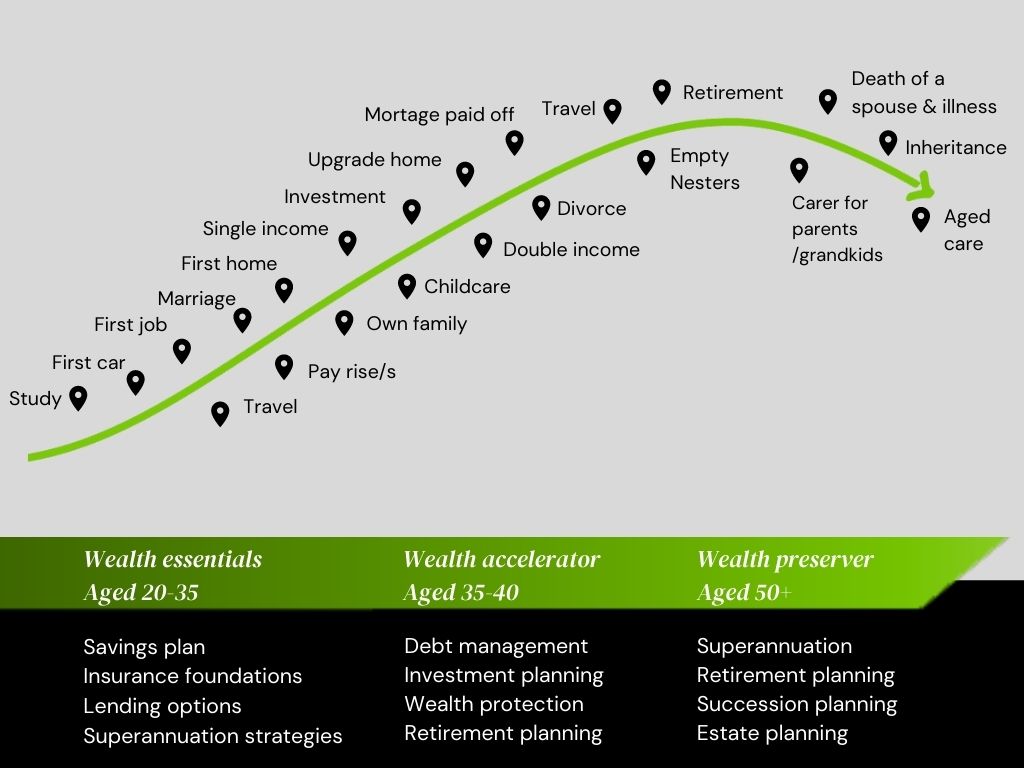

While we firmly believe that there is no age cap on wealth, life stages inevitably impact a person’s financial position. There is a series of common financial milestones through an average lifespan, including positive wealth building opportunities, as well as some of the more unpleasant and expensive realities of life. We’ve mapped them out, and have some tips on how to manage your finances at the various stages of life.

During young adulthood, many people incur many hefty expenses due to study, first-time-independent living and high discretionary spending. A Financial Plan for a person aged around 20-35 will include a savings plan to achieve material goals such as a car or house, as well as exploring optimum lending and insurance options for long-term protection.

As we enter our middle age of around 35-50, we start to enjoy the financial reward of an established career and perhaps a double income and investment return. It can also come with substantial expenses associated with children such as home upgrades, childcare, schools and extra-curricular activities. Unfortunately, divorce is a 50% reality for couples during this stage of life and can also incur significant costs. A good Financial Plan will outline a strong growth strategy such as investment options and diversity. It will continue to look forward at the savings that can be made by effective debt management and retirement planning, as well as have the important insurance protections in place. You’ve worked hard by this time and actually have a lot to lose. Time to protect what you’ve earned.

As we age past 50, we start to notice the relaxation of major expenses, indeed our income becomes noticeably freed up. It is a very rewarding financial stage when the foundations have been properly laid earlier in life. A Financial Plan will very importantly look to maximise superannuation growth and management for the retirement you deserve. This is also the time to outline your aged care preferences, family succession where it’s relevant and your estate.

Of course, not everyone will follow such a course. There are countless variables that will determine your personal situation, which is a good basis for a Financial Plan that reflects your past, present and future.

We encourage you to review your financial position and explore the options available and applicable to you, and take advantage of our complimentary Financial Discovery meeting with our experienced Financial Services team. To book, simply call us on 4320 0500.