Dollar Cost Averaging Posted on October 9, 2018

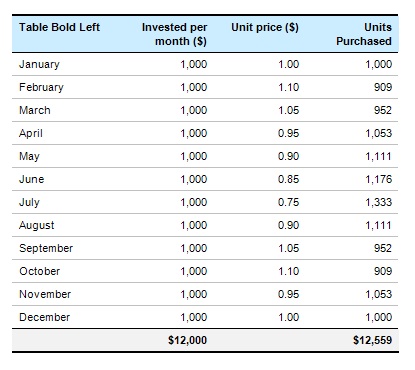

Assuming you continue to save $1,000 a month for the rest of the year, you will purchase varying quantities of units at fluctuating prices. By the end of the twelve months the unit price has returned to $1.00. At first it may seem that no gain has been made. But if you look at the number of units purchased, your investment account shows a balance of 12,559 units purchased with $12,000. With a current unit price of $1.00 the investment is now worth $12,559, $559 more than your overall contribution for the year – a return of 4.66%.

If unit prices rise consistently above $1.00 in the following years, you stand to make significant profits. Alternatively, if unit prices fall below $1.00 you may lose money. However it has been shown that Dollar Cost Averaging can be a profitable strategy over the long-term, particularly when markets are falling.

The above strategy also works well with investors who are looking to move to a higher risk profile, or who have substantial amounts invested in cash. By using the dollar cost averaging approach over a longer time period (1 year for example) you are not exposed to significant losses if the markets were to take a substantial fall whilst still ensuring you participate in any rallies in the markets.