Psychology of investing Posted on February 15, 2023

It has been a tumultuous period in the stock market over the last couple of years, with many factors influencing markets, from COVID 19 and lockdowns, supply issues driving costs up, the Russia/Ukraine war affecting energy prices, and the flow on affect to the global economy.

Government stimulus provided relief however, in turn we are now in a high inflationary environment and interest rates have been rising rapidly, ultimately impacting costs of living.

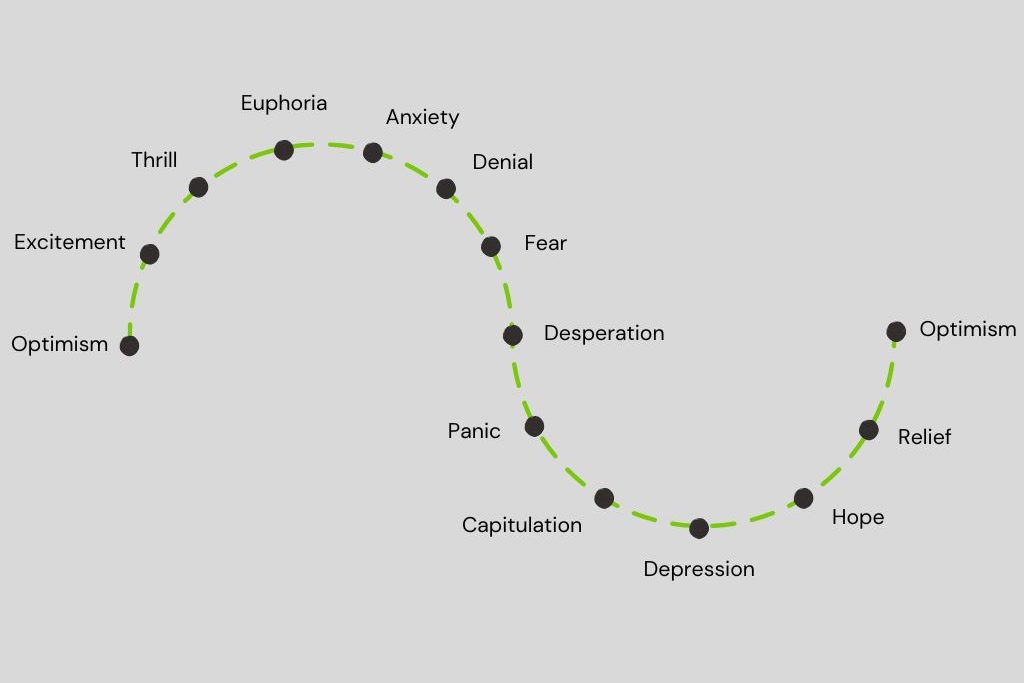

It has been a difficult time for investors, watching their investments fluctuate so significantly over this period, results in emotional swings from optimism following the rebound with government stimulus to the uncertainty and anxiety surrounded with language such as recession.

Whilst there are still factors which will ultimately result in an economic slowdown, whether it is recessionary or low growth, the key for investors to be aware when the market appears at the lowest, and be more cautious in investing in the euphoria times, commonly referred to as FOMO or fear of missing out.

At these times it does pay to seek advice as to whether your investments are of sound quality and will endure or is it an investment that may not weather any potential storm.

Fund managers and professional advisers seek to look through these periods and see opportunities to buy quality companies at lower prices, with the ability to provide long term earnings.

To safeguard against emotional responses, choose an investment strategy which remains consistent with your financial objectives and risk tolerance.

It is always prudent to have a cash reserve for any contingency and do not overact in times of volatility.

If you would like to have one of our qualified Advisers review your investments for quality and suitability for your circumstances, please contact us directly or on mail@adviceco.com.au