How much does life cost? Posted on October 9, 2018

One of the most powerful reasons to track your expenditure over several months is to become familiar with exactly where your money is going. It is very difficult to save money, and to add extra regular amounts to valuable investments, if you’re not aware of where you may be able to cut back.

Those that record their spending invariably say they are surprised by the amount of money they spend on specific things. They previously hadn’t realised quite how much came out of their accounts on a monthly or annual basis for items or services that seemed perfectly affordable at the time.

The classic example, for instance, is a cappuccino during each working day. That regular, mid morning pick-me-up from a cafe, at just $4 a day, is actually costing you around $1000 each year. But life doesn’t have to be expensive. You just need to know where to make cuts.

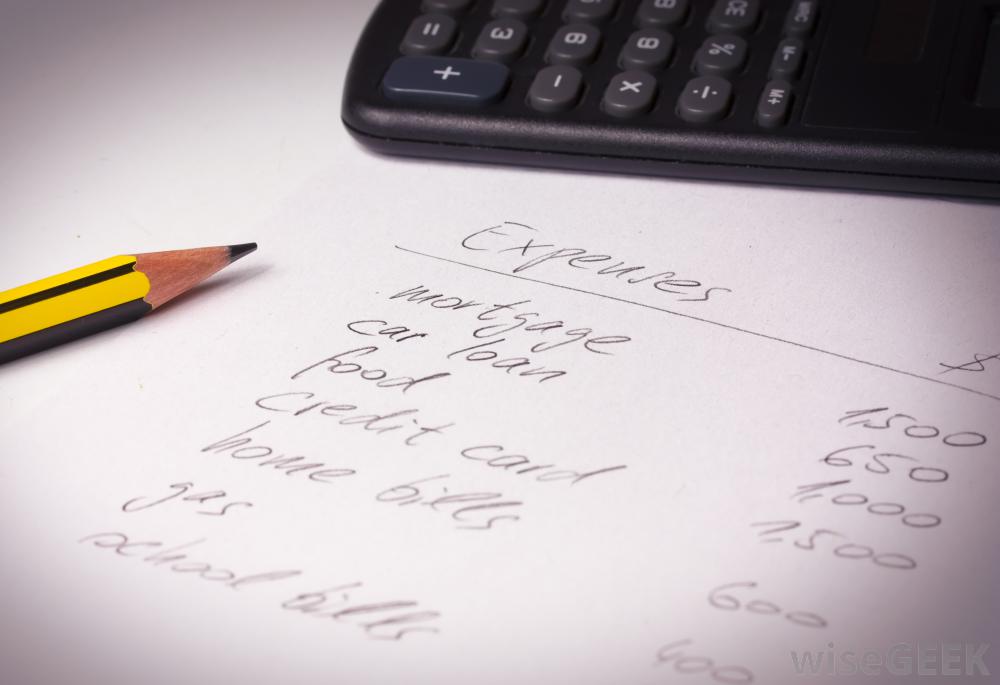

Here is a list of annual expenditures that often come out in the wash when an individual, couple or family record their spending.

And these are just some of the expenses that Australian households face on a regular basis. The trick to achieve a happy co-existence of lifestyle and wealth planning is to figure out which costs are absolute essentials and which you can do without during certain periods of your life.

Small changes can make vast differences over time. Cut out that daily cappuccino and instead put $4 from every weekday into an investment with a return rate of 5% and after 30 years you will have raised an extra $72,129. It’s not a bad reward for a small sacrifice!

If you would like to know more, click here to speak to a financial adviser who can give you further detailed information on the best approach for your situation.