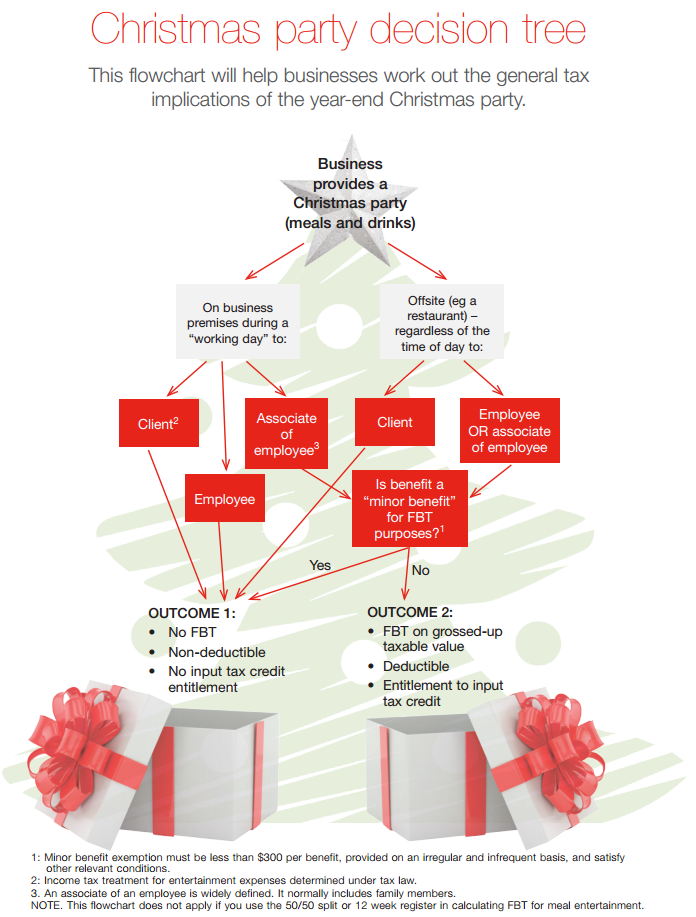

Christmas party: Examples from the ATO Posted on October 9, 2018

Example 1

A small manufacturing company decides to have a party on its business premises on a working day before Christmas. The company provides food, beer and wine.

The implications for the employer in this situation would be as follows.

If…

|

Then…

|

|

current employees only attend |

there are no FBT implications as it is an exempt property benefit. |

|

current employees and their associates attend at a cost of $180 per head |

|

|

current employees, their associates and some clients attend at a cost of $365 per head |

|

Example 2

Another company decides to hold its Christmas party function at a restaurant on a working day before Christmas and provides meals, drinks and entertainment.

The implications for the employer in this situation would be as follows.

If… |

Then… |

|

current employees only attend at a cost of $195 per head |

there are no FBT implications as the minor benefits exemption applies. |

|

current employees and their associates attend at a cost of $180 per head |

there are no implications as the minor benefits exemption applies. |

|

current employees, their associates and clients attend at a cost of $365 per head |

|

This is a complex area of the tax law, so please contact us for further guidance.