There’s a (free) app for that! Posted on October 9, 2018

-

Pocketbook (iOS, Android)

An Australian budgeting app designed for the Australian environment, Pocketbook has earned a lot of media recently. As a budgeting app it stands out because it automates virtually everything. It syncs with your bank accounts, so it misses nothing – even if your money is with several major banks. It auto-detects bills and warns you when they’re due. You can set a weekly/monthly budget called “Safely Spend’ which automatically reduces as money leaves your account, meaning you’re always aware of your spending. It will also allocate your spending into categories so you know exactly where your money is going. -

Unsplurge (iOS)

Unsplurge (iOS)

Rewards and reminders are a great way to stay focused on a savings goal and this fun but effective app is all about making sure you’re aware of how far you’ve come. Whether you’re saving towards a goal by putting money away or simply by choosing not to splurge on something specific, Unsplurge allows you to record your savings towards a specific goal as a dollar amount, as a percentage and as a remaining balance. -

Track My Spend (iOS, Android)

Developed by the Australian Securities & Investments Commission, Track My Spend makes keeping track of your personal expenses easy and enjoyable. Just enter your total budget then add each expense and its category as it happens. You can separate work, personal and goal-oriented expenses, track spending on a weekly, fortnightly, monthly or yearly basis, differentiate between ‘needs’ and ‘wants’ and much more. -

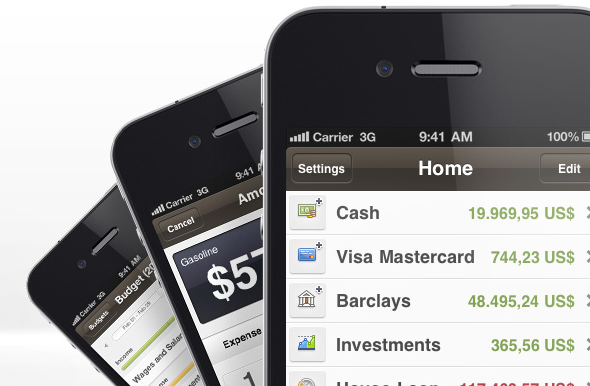

Expensify (iOS, Android, Windows Phone, Blackberry)

Expensify (iOS, Android, Windows Phone, Blackberry)

Expensify allows you to keep track of expenses on the go by taking photos of receipts – the app does the rest. It will also automatically import expenses from your local credit card or bank account, help you to record the amount you have spent in various categories, integrate with several accounting software systems such as Xero and Quickbooks and export expense reports from your phone. The desktop version allows for deeper analysis of your spending. -

Money Smart Financial Calculator (iPhone, Android)

Another very useful app from the MoneySmart team at the Australian Securities & Investments Commission, this offers easy-to-use calculators to help you figure out the true future cost of value of such things as mortgages, superannuation, loans, interest-free deals and compound interest.

If you would like to know more, click here to speak to a Robson Partners financial adviser who can give you more detailed information on the best approach for your situation.